What to Expect from the Markets this Week

This week, robust corporate earnings sustained positive sentiment in the equities market, with the NGX ASI up 5.07% for the week and 16.57% for July. Like the market outlook, the IMF says it expects Nigeria’s GDP to grow by 3.4% in 2025 and 3.2% in 2026, a position that reflects the easing inflationary pressure, relatively stable FX market, and notable growth in some sectors.

Meanwhile, global commodities traded bullish despite the US reimposing tariffs on countries. The naira strengthened at the official window amid increased reserve accretion, although holiday demand pressured the parallel market rate. Bearish sentiment returned to the fixed-income markets. We expect sustained cautiousness in fixed income, while equities are likely to stay bullish due to interest in dividend-yielding stocks and improving macroeconomic signs.

Economy

Robust Corporate Earnings Sustained Positive Sentiment in the Equities Market

In the week ending August 01, 2025, a number of listed entities reported H1 2025 results. First Holdco saw a 51.67% surge in interest income to N1,437.41bn, despite higher impairment charges, driven by increased loans and investment income. ETI’s profit before tax rose 39.85% across its 35-country operations, reflecting a resilient diversified strategy. FCMB Group reported a 23% increase in profit before tax to N79.3bn, while Dangote Cement’s revenue grew 17.7% to N2.07trn, with profits soaring due to higher finance income. Presco Plc achieved a 121.8% revenue increase. Other firms like Aradel Holdings (N146.39bn PAT), Sterling Financial (N41.78bn PAT), Nestle Nigeria (N50.57bn PAT), UAC Nigeria (N7.36bn PAT), Seplat Energy (N42.52bn PAT), Transcorp Group (N85.7bn PBT), Unilever Nigeria (54% revenue growth), United Capital (N11.89bn PAT), and Transcorp Power (N44bn PAT) also posted strong results with significant revenue and profit growth. These rather impressive corporate earnings, underpinned by improved operational efficiencies and favourable macroeconomic conditions, despite weakening micro indicators, should sustain the NGX’s bullish momentum, as investors’ confidence strengthens amidst interim dividends announcements.

IMF Upgrades Nigeria’s FY 2025 Growth Projection to 3.4%

The International Monetary Fund (IMF) has revised and upgraded Nigeria’s economic growth projection for 2025 to 3.4% from 3.0% forecast published in its April 2025 World Economic Outlook. The upgrade comes due to increased confidence in ongoing reforms in the Nigerian economy. Global growth is projected to reach 3.0% in 2025 and 3.1% in 2026. The IMF’s Projection for 2026 growth was also upgraded by 0.5% points to 3.2%. The IMF report follows the National Bureau of Statistics (NBS) recent disclosure Nigeria Rebased GDP report, revealing that the Nigerian economy’s size stood at N372.82trn as of 2024, equivalent to US$244bn (using an exchange rate of N1,550/US$), compared to N277.49trn (approximately US$188bn) under the old base year. In terms of growth, GDP rose by 3.38% at the end of 2024 from 3.04% in 2023. Quarterly performance indicates that real GDP grew by 3.13% year-on-year (YoY) in Q1 2025, up from 2.27% in Q1 2024. We expect a sustained confidence level in the economy to drive above 3% growth; however, it lags behind the required 7% growth needed to attain the ambition for US$1trn economy by 2030.

FIRS Halts Issuance of Tax Exemption

The Federal Inland Revenue Service (FIRS) in a public notice revealed that it will discontinue the issuance of tax exemption certificates to all categories of taxpayers, including pioneer status companies, non-governmental organisations, and free zone entities. The Exemption is due to uncertainties over the programme’s effectiveness. Existing pioneer status certificates will run till expiry. The number of Pioneer status companies in Nigeria stood at 105 in Q1 2024 from 31 in 2021, and the FIRS notes that at least N6trn was lost due to tax waivers from pioneer status in 2021. Economic Development Incentive is expected to replace Pioneer Status Incentive; however, the definition of what constitutes an economic development company remains unclear amidst concerns about how the impact of Economic Development Incentive will be monitored.

Table 1:

| Global Economic Spotlight This Week | ||

| Indicator | Outcome | What to Expect |

| Ghana Prime Interest Rate Decision in July 2025 | 25% from 28% | More rate cuts and stronger growth |

| Eurozone GDP Growth – Q2 2025 (PREL) | 0.1% from 0.6% in Q1 2025 | Subdued growth to persist |

| US GDP – Q2 2025 (PREL) | 3% from -0.5% in Q1 2025 | Tariff impact may weaken growth |

| Canada BoC Interest Rate Decision | Held at 2.75% | Align with analysts’ expectations |

| US Fed Interest Rate Decision | Held at 4.5% | Align with analysts’ expectations |

| Japan BoJ Interest Rate Decision | Retained at 0.5% | Align with analysts’ expectations |

| South Africa Prime Rate Decision in July 2025 | 10.50% from 10.75% | Increased private sector activity |

| China NBS Manufacturing PMI – July 2025 | 49.3 from 49.7 in June 2025 | Current level to persist |

| Canada GDP Growth – May 2025 | -0.1%, same as April 2025 | Subdued growth to persist amidst tariff uncertainties |

Table 2:

| Global Economic Spotlight in the Week Ahead | |

| Indicator | Date |

| Nigeria Stanbic IBTC PMI – July 2025 | Mon, August 04, 2025 |

| Eurozone HCOB composite PMI – July 2025 | Tue, August 05, 2025 |

| US S&P Composite PMI – July 2025 | Tue, August 05, 2025 |

| US Goods Trade Balance – June 2025 | Tue, August 05, 2025 |

| South Africa PMI | Tue, August 05, 2025 |

| Ghana PMI | Tue, August 05, 2025 |

| China Trade Balance – July 2025 | Thu, August 07, 2025 |

| BoE Interest Rate Decision | Thu, August 07, 2025 |

| Canada Ivey PMI – July 2025 | Thu, August 07, 2025 |

| Ghana Inflation Rate – July 2025 | Fri, August 08, 2025 |

| China FDI – July 2025 | Fri, August 08, 2025 |

Commodity Market

Global Commodities

Despite a mild reprieve at the end of the week, global commodities ended the week bullish. Gold prices ticked up after much weaker U.S. jobs data. Brent and WTI crude futures rose amidst US tariffs on dozens of countries taking effect and jitters about a possible increase in production by OPEC and its allies (see Table 3 below).

Table 3:

| Global Commodities Prices | |||||

| Commodity | December 31, 2024 | July 25, 2025 | August 01, 2025 | Weekly Change | YTD Change |

| Brent | 74.39 | 68.58 | 69.69 | 1.62% | -6.32% |

| WTI | 71.59 | 65.31 | 67.38 | 3.17% | -5.88% |

| Gold | 2,624.00 | 3,330.00 | 3,394.40 | 1.93% | 29.36% |

| Silver | 29.395 | 38.235 | 36.905 | -3.48% | 25.55% |

| Platinum | 911.20 | 1,415.50 | 1,324.10 | -6.46% | 45.31% |

| Palladium | 901.00 | 1,257.00 | 1,215.50 | -3.30% | 34.91% |

| CNBC, Proshare Research | |||||

*Data for August 01, 2025, is as of 05:35 pm (Nigerian Time)

Local Commodities

The AFEX commodities ended the week mixed. Maize prices rose as investors took positions ahead of a possible price increase as major producing states pivot to other commodities. Cocoa price dropped as supply concerns receded (see Table 4 below).

Table 4:

| AFEX Commodity Prices | |||

| Commodities | July 25, 2025 | August 01, 2025 | % Change |

| Maize | 414.25 | 451.81 | 9.07% |

| Sorghum | 496.54 | 521.50 | 5.03% |

| Cocoa | 12081.25 | 11750.00 | -2.74% |

| Paddy rice | 613.75 | 602.50 | -1.83% |

| Ginger | 990.00 | 990.00 | 0.00% |

| Sesame | 2300.00 | 2300.00 | 0.00% |

| Soybeans | 808.13 | 808.13 | 0.00% |

| Cashew | 1899.86 | 1899.86 | 0.00% |

| Wheat | 440.00 | 440.00 | 0.00% |

AFEX, Proshare Research *Data for August 01, 2025, is as of 04:44 pm (Nigerian Time)

Lagos Commodities Market

Commodities at the Lagos Commodities and Futures Exchange (LCFE) closed the week bullish. Eko Gold rose by 3.85% as broad market optimism filters into the commodities space (see Table 5 below).

Table 5:

| LCFE Commodity Prices | |||

| Commodities | July 25, 2025 | August 01, 2025 | % Change |

| Eko Gold | 130,000.00 | 135,000.00 | 3.85% |

| Premium Eko Rice | 90,000.00 | 90,000.00 | 0.00% |

LCFE, Proshare Research *Data for August 01, 2025, is as of 04:44 pm (Nigerian Time)

Analysts expect the market to exhibit a close trend in the coming week.

Fixed Income Market

Currency Market

This week naira traded mixed in the currency market. The official rate appreciated by 6bps to settle at N1.533.74/US$1, while in the parallel market, the naira remained flat at N1,540/US$1 week-on-week.

However, on a month-on-month (M-o-M) basis, the naira depreciated by 27bps from N1,529.58/US$1 on July 1, 2025, to N1,533.74/US$1 on August 1, 2025 (see Table 6 below).

Table 6:

| Naira/Dollar at NAFEM and BDC | ||||

| Rates | July 25, 2025 | August 01, 2025 | W-o-W

Change (%) |

M-o-M

Change (%) |

| Official | 1,534.72 | 1,533.74 | 0.06% | -0.27% |

| Parallel Market | 1,540.00 | 1,540.00 | 0.00 | – |

Source: CBN, BDC, Proshare Research

Money Market

In the interbank market, funding rates closed mixed. The Open Repo Rate (OPR) remained flat at 26.50% for the second consecutive week. The Overnight rate (O/N) inched up by 2bps to close at 26.90% from 26.92% in the previous week.

On a month-on-month (M-o-M) basis, the Open Repo Rate stayed steady at 26.50%, while the overnight rate (O/N) increased by 6pbs from 26.96% to 26.90% (see Table 7 below).

Table 7:

| Money Market | ||||

| Rates | July 25, 2025 | August 01, 2025 | W-o-W

Change (bps) |

M-o-M

Change (bps) |

| OPR (%) | 26.50 | 26.50 | 0.00 | 0.00 |

| O/N (%) | 26.92 | 26.90 | 0.02 | 0.06 |

Source: FMDQ, Proshare Research

We expect rates to tick up in response to the FGN Bond auction scheduled for next week.

Nigerian Treasury Bill

The secondary market had a mixed performance this week. The NTB segment traded bearish as the average benchmark yield increased by 12bps from 17.68% the previous week to 17.79% this week, indicating some selloffs. Conversely, the OMO segment experienced a decline in the average benchmark yield by 1bp to settle at 24.82%

The average benchmark yield on both the NTB and OMO bills declined on a M-o-M basis. The NTB fell by 202bps from 19.81% on July 1, 2025, while the OMO bill decreased by 55bps from 25.37%. (see Table 8 below).

Table 8:

| Average Benchmark Yields of the Treasury Bills Market | ||||

| Bills | July 25, 2025 | August 01, 2025 | W-o-W

Change (bps) |

M-o-M

Change (bps) |

| T. Bills (%) | 17.68 | 17.79 | 0.12 | -2.02 |

| OMO bills (%) | 24.84 | 24.82 | -0.01 | -0.55 |

Source: FMDQ, Proshare Research

We expect cautious optimism in the coming week.

FGN Bond Market

FGN Bond traded mixed in the secondary market, with the average benchmark rose by 7bps to 16.21% from 16.14% the previous week as yields in the mid-tenor increased by 29bps to close at 16.49%. Short- and long-term yields declined by 42bps and 10bps to 16.59% and 15.71% respectively.

The benchmark yields declined across all tenors on a M-o-M basis. Yield on the short-, mid- and long-tenors fell by 350bps, 460bps and 228bps respectively (see Table 9 below).

Table 9: Average Benchmark Yields of the FGN Bonds

| Average Benchmark Yields of the FGN Bonds | ||||

| Tenor | July 25, 2025 | August 01, 2025 | W-o-W

Change (bps) |

M-o-M

Change (bps) |

| Short-term | 17.01 | 16.59 | -0.42 | -3.50 |

| Mid-term | 16.20 | 16.49 | 0.29 | -4.60 |

| Long-term | 15.81 | 15.71 | -0.10 | -2.28 |

Source: FMDQ, Proshare Research

We expect investor sentiment to lower rates around the short and long-term instruments.

FGN Bond Auction

The week began with the DMO offering an FGN bond auction. The auction, which had an offer of N80bn, was oversubscribed with a bid-to-cover ratio of 3.76x. The DMO allocated 232.42% of the amount offered, deviating from the norm. Increased investor optimism pushed the bond price higher, causing the yield to decrease. The stop rates on the Apr 2029 and Jun 2032 instruments fell by 206bps and 205bps to 15.56% and 15.90% respectively compared to the previous auction (see Table 10 below).

Table 10:

| Bond Name | Amount offered (N’bn) | Total Subscription (N’bn) | Amount Allotted (N’bn) | Marginal Rate (%) | Previous Stop Rate (%) |

| 19.30% FGN APR 2029 | 20.00 | 39.08 | 13.43 | 15.69 | 17.75 |

| 17.95% FGN JUN 2032 | 60.00 | 261.60 | 172.50 | 15.90 | 17.95 |

We expect cautious investor optimism to drive down yields in subsequent auctions.

Equities Market

NGX – Listed Equities:

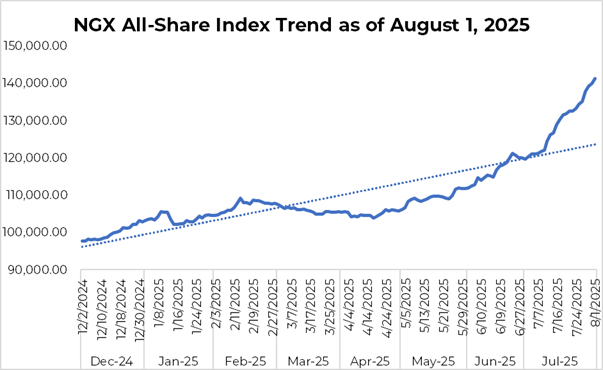

The NGX equities market sustained a bullish momentum for the tenth consecutive week, crossing an all-time high of 141,000 points, driven by increased activity in the Industrial Goods, Banking and Consumer Goods Sectors.

The NGX All-Share Index (ASI) posted a significant increase of 5.07%, closing at 141,263.05 points from 134,452.93 points the previous week. Market capitalisation rose to N85.06 trillion from N83.24 trillion the week before, a 5.08% WTD increase. The growth in market cap partly reflects the listing of 11.5m ordinary shares of Seplat on Friday, August 1, 2025, as well as the delisting of MRS Oil Nigeria Plc on Monday, July 28, 2025(see chart 1 below).

Chart 1:

Fifty-four equities gained this week, led by heavyweights like MTNN (+20.00%), BUACEMENT (+9.63%), DANGCEM (+7.16%), BUAFOODS (+5.32%), WAPCO (+19.15%), ETI (+17.03%), BETAGLAS (+16.71%), PZ (+15.44%), DANGSUGAR (+12.88%), NASCON (+10.61%), and GUINNESS (+9.96%). In comparison, forty-nine equities declined, led by NAHCO (-15.13%), OANDO (-11.57%), HONYFLOUR (-11.11%), VITAFOAM (-10.13%), NNFM (-10.00%), FIRSTHOLDCO (-7.73%) and ETERNA (-5.44%).

A total turnover of 4.85bn shares worth N149.76bn in 174,267 deals was traded this week on NGX, in contrast to a total of 3.69bn shares valued at N112.26bn that exchanged hands last week in 138,250 deals.

The Financial Services Industry led the activity chart with 3.31bn shares valued at N61.08bn traded in 70,239 deals, contributing 68.37% and 40.79% to the total equity turnover volume and value, respectively. The Consumer Goods Industry followed with 326.46m shares worth N19.78bn in 23,764 deals.

Of the twenty-one indices under our coverage for the week, eighteen indices gained, led by the NGX Growth Index, while two indices lost, led by the NGX Insurance Index (see Table 11 below).

Table 11:

| Sectoral Index Performance as of August 1, 2025(%) | ||||

| Index | WtD | MtD | QtD | YtD |

| NGX Growth Index | 12.26% | 0.00% | 17.49% | 42.57% |

| NGX Industrial Goods Index | 10.12% | 3.49% | 38.96% | 41.53% |

| NGX Premium Index | 9.21% | 0.64% | 27.55% | 51.92% |

| NGX Lotus II | 8.18% | 1.06% | 25.96% | 67.14% |

| NGX MERI Growth Index | 7.06% | 2.25% | 26.50% | 58.83% |

| NGX Pension Board Index | 5.98% | 1.22% | 19.56% | 42.66% |

| NGX 30 Index | 5.13% | 0.97% | 17.24% | 36.03% |

| NGX All-Share Index (ASI) | 5.07% | 1.00% | 17.74% | 37.25% |

| NGX MERI Value Index | 5.04% | -0.07% | 30.27% | 40.01% |

| NGX CG Index | 4.69% | 0.24% | 25.16% | 52.84% |

| NGX Pension Index | 4.37% | 0.13% | 19.24% | 52.94% |

| NGX-AFR Bank Value Index | 3.85% | -0.38% | 28.95% | 54.58% |

| NGX Banking Index | 3.49% | 0.52% | 26.44% | 49.27% |

| NGX-Main Board Index | 2.80% | 1.21% | 12.74% | 33.08% |

| NGX Consumer Goods Index | 2.72% | 1.61% | 12.93% | 71.89% |

| NGX AFR Div Yield Index | 1.78% | 0.41% | 19.16% | 39.55% |

| NGX Commodity Index | 0.81% | -0.32% | 4.65% | 0.00% |

| NGX Sovereign Bond Index | 0.70% | 0.00% | 3.04% | 11.86% |

| NGX ASeM Index | 0.00% | 0.00% | -9.32% | -8.67% |

| NGX Oil/Gas Index | -0.48% | -1.73% | -0.03% | -10.16% |

| NGX Insurance Index | -1.22% | -0.29% | 17.40% | 23.53% |

Source: NGX, Proshare Research

NASD OTC EXCHANGE – Unlisted Equities

The unlisted NASD OTC market closed bullish for the week, sustaining the bullish trend seen for the past five weeks, with the NSI climbing 1.87% to close at 3,701.67 points from 3,633.79 points the previous week.

The total volume and value traded for the week also decreased by 99.57% and 76.59%, respectively. The market capitalisation also appreciated 1.88% to close at N2.17trn.

The market uptick was driven by gains in CSCS (+21.29%), FOODCPT (+2.95%), GEFLUID (+2.61%), OKITIPUPA (+1.71%), and NIPCO (+0.42%), which overpowers the losses in FCWAMCO (-4.69%), 11PLC (-9.40%), and NASD (-9.83%) (see Table 12 below).

Table 12:

| NASD Market Snapshot W-o-W | |||

| Parameter | July 25, 2025 | August 01, 2025 | W-o-W |

| Changes (%) | |||

| NASD NSI | 3,633.79 | 3,701.67 | 1.87 |

| Mkt Capitalisation (N’trn) | 2.13 | 2.17 | 1.88 |

| Volume Traded | 1,404,751,693 | 6,027,973 | 99.57 |

| Value Traded (000) | 559,635,929 | 131,037,714 | 76.59 |

| Deals Executed | 224 | 183 | 18.30 |

Source: NASD, Proshare Research

Proshare Indices

The Proshare Memorandum Index continued its positive momentum, sustaining the trend seen over the last nine weeks, increasing by 2.62% to close at 617.77 points, slightly underperforming the NGXASI (see Table 13 below).

Table 13:

| Proshare Index W-o-W | |||

| Index | July 25, 2025 | August 01, 2025 | W-o-W |

| Changes (%) | |||

| Proshare Index | 601.98 | 617.77 | 2.62% |

We expect sustained optimism in the coming week on system liquidity, the interim dividends announcement, and improving macroeconomic indicators.