20 Best-Performing Developmental Economic Countries in Africa, by Multiple Metrics

When you ask “which are the richest countries in Africa,” the answer depends a lot on what you mean by rich. Do you mean total GDP (size of the economy)? GDP per person (how much the average citizen earns)? Human development index (health, education, standard of living)? Political stability, social welfare? In 2025, certain African nations stand out across several of these dimensions and the richest in one sense are not always the richest in another.

![]()

Here are the leading countries and what drives their success, and where challenges remain.

To identify the best-performing economic developmental countries in Africa, it’s necessary to analyze multiple metrics, as a single indicator like GDP growth can be misleading. A comprehensive assessment should include factors such as the Human Development Index (HDI), economic stability and business environment. For example, countries with high HDI scores indicate strong performance in health, education and living standards.

Below are 20 of Africa’s strongest economic performers, based on recent analysis from sources like the United Nations Development Programme (UNDP), the World Bank, Transparency International and Business Insider Africa.

Top-tier developed nations:

These island nations are outliers in Africa, consistently achieving “Very High Human Development” status.

- Mauritius: Ranks as Africa’s most developed nation with a “Very High Human Development” score. It has a diverse, stable economy, strong business climate, and high marks for transparency.

- Seychelles: This island nation is another standout performer, leading Africa in GDP per capita and consistently scoring very high on the HDI. It is also ranked as the least corrupt country on the continent.

Strong performers with high Human Development Index (HDI) scores:

These countries are generally known for political stability, good governance and high levels of human development

3. Algeria: With a high HDI score, Algeria stands out in Northern Africa for having one of the continent’s highest life expectancy rates. It also holds a high ranking for governance.

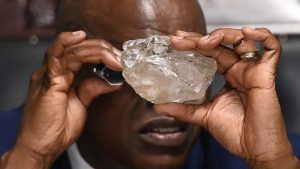

4. Botswana: Recognized for its stable democracy and good governance, Botswana has used its mineral wealth, particularly from diamonds, to achieve sustained economic growth and high human development.

5. Tunisia: A high-income country in North Africa, Tunisia has a strong HDI score and performs well in business climate assessments.

6. Egypt: This economic heavyweight is one of Africa’s largest economies by total GDP and offers a fast-improving business environment, especially in areas like energy and logistics.

7. Gabon: Possesses a high GDP per capita and HDI score, backed by its oil reserves. The country has made steady progress in human development.

8. South Africa: Features Africa’s most diversified and industrialized economy. It has robust financial systems and a strong business infrastructure.

Rising economies with strong growth

These nations have consistently appeared on lists of the fastest-growing economies in recent years.

9. Rwanda: Praised for its rapid economic growth and business climate reforms, Rwanda consistently ranks high in measures of government efficiency and operational effectiveness.

10. Morocco: This North African country is a key trade and logistics hub for Europe and Africa. It has shown strong economic growth driven by its manufacturing and tourism sectors.

11. Kenya: The “Silicon Savannah” of East Africa, Kenya has a rapidly growing tech sector and a strong overall economy. The country has consistently attracted foreign investment.

12. Côte d’Ivoire: One of West Africa’s fastest-growing economies, driven by reforms and booming sectors like agriculture and telecoms.

13. Senegal: Projected to see high GDP growth driven by investments in its energy sector. The government’s economic reforms have also played a significant role.

14. Ghana: A politically stable West African nation with a consistently favorable business environment. It has seen strong growth in recent years and has a well-educated population.

15. Namibia: A politically stable Southern African country with a medium-to-high HDI ranking.

16. Tanzania: Has benefited from reasonable economic policies and a stable political environment, attracting consistent investment in sectors like finance and telecommunications.

17. Benin: Noted for its strong economic growth rate in recent years, backed by business-friendly policies.

18. Uganda: Projected to achieve robust growth in 2025 due to progress in infrastructure and oil exploration investments.

19. Ethiopia: A major economic force with one of the continent’s largest populations. Its economy is showing strong growth and is underpinned by industrial and agricultural sectors.

20. Zambia: In the past decade, Zambia has been one of Africa’s fastest-growing economies, known for its political stability and strong mining sector.

Economic Scale: Who Has the Biggest Economies?

In nominal GDP terms (i.e. total output at current exchange rates), some of Africa’s largest economies in 2025 continue to be:

- Nigeria leads the continent by total economic size.

- South Africa follows, with a diversified economy including mining, finance and manufacturing.

- Egypt is also near the top in terms of scale, thanks to its large population, agriculture, tourism, energy, construction.

These are the economies with power and scale. But scale alone doesn’t tell us how well ordinary people live.

GDP Per Capita & Standard of Living: Wealth per Person

To understand how wealthy a country is for its citizens, GDP per capita (especially adjusted for purchasing power parity, PPP) is a much better metric. According to IMF/related sources:

| Country | Approximate GDP-PPP Per Capita, Ranking | Key Economic Drivers |

| Seychelles — about $43,070 | Tourism, fisheries, financial services; small population makes high per-person income possible. | |

| Mauritius — about $33,954 | Diversified services economy, manufacturing, financial services, strong business climate. | |

| Gabon — around $24,682 | Oil, natural resources; efforts to diversify. | |

| Egypt — approx $21,600 | Mixed economy: tourism, remittances, agriculture, manufacturing, energy. | |

| Botswana — ~$20,311 | Mineral wealth (diamonds), stable governance, reinvestment in infrastructure and social services. | |

| Equatorial Guinea, Algeria, Libya, South Africa, Tunisia also feature in the top ranks when considering GDP per capita. |

Africa’s Deepening Economic Crisis: Implications across society, governance and growth

Over the past several years, many African nations have slipped deeper into economic distress. High inflation, mounting government debt, external shocks (such as climate-related disasters and commodity price volatility), weak institutional capacity, and rising borrowing costs are combining to erode living standards. As states struggle to balance budgets, citizens bear the brunt. This crisis is not merely financial—it reaches into human welfare, political stability, culture, and the very fabric of communities.

Economic Frameworks and Regional Actors

- Macroeconomic Policy Weakness: Many governments have run large fiscal deficits without credible plans for revenue mobilization or spending efficiency. Reliance on external borrowing rather than domestic revenue (taxes, royalties) increases vulnerability to foreign exchange risk. Monetary policies are under pressure: central banks battling inflation, currency depreciation, and capital flight.

- Trade and Regional Integration: Trade among African countries remains sub-optimal due to infrastructure gaps, non-tariff barriers, and weak logistical networks. Where regional blocs (such as ECOWAS, East African Community, COMESA, SADC) have greater integration, there is potential for resilience but implementation lags.

- External shocks: Climate change (droughts, floods, erratic rains), commodity price swings (oil, minerals, agricultural raw materials), global interest rate rises and supply chain disruptions weigh heavily on many economies. Countries dependent on single-commodity exports are especially vulnerable.

- Actors: Key players include national governments, regional economic communities, international financial institutions (IMF, World Bank, African Development Bank), foreign investors, aid donors, and civil society. Their interactions aid conditionality, debt relief negotiations, trade agreements and shape the response to the crisis.

Broader Implications

Human and Family

- Food insecurity rises as inflation pushes up prices of staples, making them unaffordable for lower- and middle-income households. Subsistence farmers suffer both from climate shocks and input scarcity.

- Health & Education suffer when governments cut budgets. Families face higher out-of-pocket costs for basic services; malnutrition and mortality risk increase.

- Migration: Economic desperation triggers migration (both internal, from rural to urban and international), leading to family separation and social strains.

Cultural Impact

- Traditional livelihoods (fishing, small-scale farming, artisan crafts) are disrupted by climate change, market displacement, or loss of infrastructure. Cultural practices tied to agriculture or land use risk decline.

- Social cohesion can fray amid inequality or perceived unfairness in how crises are handled. In many places, youth disillusionment grows where opportunities shrink, increasing risk of radicalization or unrest.

Business and Economy

- Small and medium enterprises (SMEs) are squeezed by high borrowing costs, unreliable infrastructure (especially power), and supply chain disruptions. Many shut down or scale back.

- Investment dries up in risk-averse sectors; capital flows favor extractives or sectors with foreign backing, leaving many parts of the economy underdeveloped.

- Currency depreciation and inflation erode real wages and consumer demand, depressing domestic markets.

Politics and Governance

- Rising unrest and political opposition in countries where economic hardship is severe. Citizens demand accountability, transparency, and reform.

- Governments may resort to populist measures, subsidies, wage increases, sometimes without sustainable financing, deepening fiscal risk.

- Corruption often becomes more prominent during crises: opaque contracts, emergency procurements, or misallocation of aid or resources.

Social Dimensions

- Gender inequalities deepen, as women often carry burdens of care, food security, and navigating informal economies.

- Education disruption exacerbates inequality (children in poor or rural areas are more likely to lose access).

- Social safety nets are overstretched or absent, increasing vulnerability among elderly, disabled, low-income families.

GDP & Economic Growth

- Growth rates are sluggish or negative in many countries. Even where nominal GDP grows, when adjusted for inflation, population growth, and currency strength, per capita gains may be minimal or negative.

- Debt burdens (both domestic and foreign) are rising, often coming with heavy servicing costs that crowd out investment in infrastructure, health, education.

- Lower growth undermines government revenues, creating a vicious cycle of deficit spending, inflation, and further economic deterioration.

Regional Variations

- North Africa: Oil- and gas-rich states somewhat insulated but still exposed to global energy demand, political instability and pressures for diversification.

- Sub-Saharan Africa: Diverse performance; some fast-growing economies (often with structural reforms, good governance, and favorable demographics), others severely challenged by conflict, climate impacts, or infrastructural deficits.

- Small island economies (Seychelles, Mauritius) generally perform better on per capita income, helped by tourism, financial services and smaller populations, but vulnerable to global shocks (pandemics, climate, changes in travel).

Policy Implications

To reverse or mitigate the crisis, several steps are essential:

- Fiscal reforms aimed at broadening tax bases, reducing waste and corruption, and reprioritizing expenditure to social spending and infrastructure.

- Debt restructuring and relief, especially for heavily indebted poor countries, to free up fiscal space.

- Strengthening institutional capacity, legal, judicial and regulatory, to build confidence and attract private investment.

- Investing in resilient infrastructure, especially in energy, transport, digital connectivity, which can reduce business risk and support economic diversification.

- Promoting inclusive growth, ensuring marginalized groups (rural communities, women and youth) are not left behind.

- Regional cooperation, easing trade barriers, harmonizing policies, joint investment in cross-border infrastructure (roads, energy grids, water management).

If current trajectories persist without strong reforms and support, declines in living standards may worsen, political instability could increase, and social fractures deepen. Conversely, countries that manage to stabilize inflation, reform debt, improve governance, and invest in human capital may see moderate but sustained growth, improved resilience, and stronger social cohesion. The gap between better-governed and poorly governed states may widen, making regional inequality more acute.

Richest African Countries in 2025

Here are two ways of measuring “richest”: total output (nominal GDP) and income per person (GDP per capita, often adjusted for purchasing power parity – PPP).

| Rank | Country | Measure | Key Facts |

| By GDP (Nominal) | |||

| 1 | Nigeria | ~US$ 510 billion | Africa’s largest economy by total output, driven by oil, growing services and tech sectors. |

| 2 | South Africa | ~US$ 399-403 billion | Mining, finance, manufacturing are big strengths. |

| 3 | Egypt | ~US$ 387-398 billion | Broad economy: tourism, construction, agriculture. |

| 4 | Algeria | ~US$ 240-260 billion | Energy sector (oil and gas) major; public investment important. |

| 5 | Morocco / Kenya / Ethiopia etc. | follow behind with US$ 150-160 billion range | Countries like Kenya, Morocco, Ethiopia showing diversified growth, especially from services, agriculture and manufacturing. |