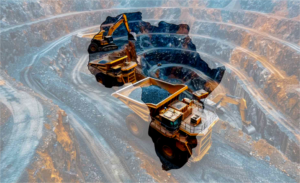

AfDB’s $310m Boost to FirstRand Signals Strategic Push for Inclusive Growth in South Africa

PRETORIA, South Africa: The African Development Bank’s approval of a $310 million financial package for FirstRand Bank, marks one of the most significant multilateral interventions this year aimed at reshaping South Africa’s small-business landscape. With a sole purpose to expanding lending to MSMEs, women entrepreneurs and agribusinesses. The package carries a positively-great business, political and social implications at a time when confidence in the country’s growth prospects is mixed.

At the centre of the announcement is an explicit commitment to gender inclusion: $110 million, more than one-third of the total facility, is dedicated to women-owned and women-led MSMEs. For the Bank, this is both a developmental priority and a strategic economic bet. Women entrepreneurs in South Africa remain significantly underfunded despite high rates of business participation; unlocking their capacity is increasingly seen as both a social good and a competitive economic lever.

The package is structured around three core elements: a $200 million line of credit to expand MSME lending across sectors; a $100 million gender-specific line for women entrepreneurs; and a $10 million concessional facility designed specifically for women-owned agribusinesses under the Agri-Food SME Catalytic Financing Mechanism. The concessional portion, although small, targets one of the country’s most structurally undercapitalised sectors, the smallholder agriculture where women often play central but under-recognised roles. Breathing business impact: a lifeline for MSMEs, a reputation-boost for FNB.

The transaction positions FirstRand Bank through its commercial arm, to significantly entrench its role in MSME financing. An arena where commercial banks have historically been cautious due to perceived high risk. With AfDB’s backing, FNB gains both capital and credibility at a moment when South Africa’s private sector is under pressure to demonstrate tangible support for job creation.

In consideration of businesses in this pedestal, especially micro and small enterprises, the increased availability of medium-term relatively affordable credit, could ease long-standing constraints around cash flow, business expansion and hiring. The inclusion of technical assistance and performance-based incentives, suggests that the package goes beyond financing to addressing structural barriers such as creditworthiness, financial literacy and agricultural risk management.

On the side of FirstRand, the arrangement strengthens its profile as a partner for development finance institutions and signals investor confidence in its governance and outreach capacity at a time when the financial sector is navigating slow growth and political scrutiny. Wielding a vote of confidence and a public nudge.

From the government stance, the package functions as a vote of confidence in South Africa’s reform trajectory, despite ongoing challenges in energy reliability, logistics and regulatory uncertainty. Multilateral institutions have in recent years taken a cautious stance on large-scale commitments to South Africa; this approval therefore sends a message both to markets and policymakers that targeted, inclusive growth interventions remain viable.

The gender component also aligns with a broader push by the government and continental institutions to address the financing gap faced by women-led businesses. AfDB’s AFAWA initiative, under which part of this financing falls, has become a diplomatic tool as much as a development vehicle. Supporting national governments in meeting gender-equity goals.

At the same time, the emphasis on agriculture subtly underscores persistent policy concerns. Smallholder farmers, most of whom are black and many of whom are women, continue to struggle with land tenure issues, market access and financing. By directing concessional funds specifically to this cohort, the Bank places pressure on domestic institutions to accelerate reforms and support mechanisms.

The household-level implications of the package are equally significant. Women-owned MSMEs often support extended families and employ community members, meaning that increased access to finance can translate directly into improved household stability. In rural areas, supporting women in agriculture affects not only income but food security, education outcomes and intergenerational mobility.

With great regard to families operating micro-enterprises such as spaza shops, small farms, informal services, etc., the potential for formal credit access can shift businesses from survivalist to growth-oriented models. This could help absorb more youth employment, a critical issue in a country where joblessness among young people continues to exceed 40%.

Both AfDB and FirstRand emphasise that the financing is part of a broader, long-term partnership. The package aligns with the AfDB’s Four Cardinal Points and its Ten-Year Strategy (2024–2033), which prioritises inclusive growth, gender equality and private-sector development. For South Africa, where MSMEs account for a large share of employment but a disproportionately small share of lending, the initiative could serve as a blueprint for future financial sector reforms.

Ultimately, the package is transcend capital injection. It is an attempt to redefine how growth is financed in South Africa: from the ground up, with women and small businesses at the centre. Whether it succeeds will depend not only on FNB’s execution and AfDB’s support, but also on the broader economic and political environment in which South African entrepreneurs continue to operate.