AfDB’s $100 Million Loan to EAAIF Aims to Unlock New Era of Inclusive, Climate-Resilient Infrastructure

ABIDJAN, Ivory Coast – the African Development Bank Group (AfDB) has approved a $100 million loan to the Emerging Africa and Asia Infrastructure Fund (EAAIF), marking a significant boost to sustainable infrastructure efforts across the continent. The financing is expected to strengthen Africa’s ability to attract private capital for essential projects, from renewable energy to digital connectivity, that underpin economic transformation and improve daily life for millions.

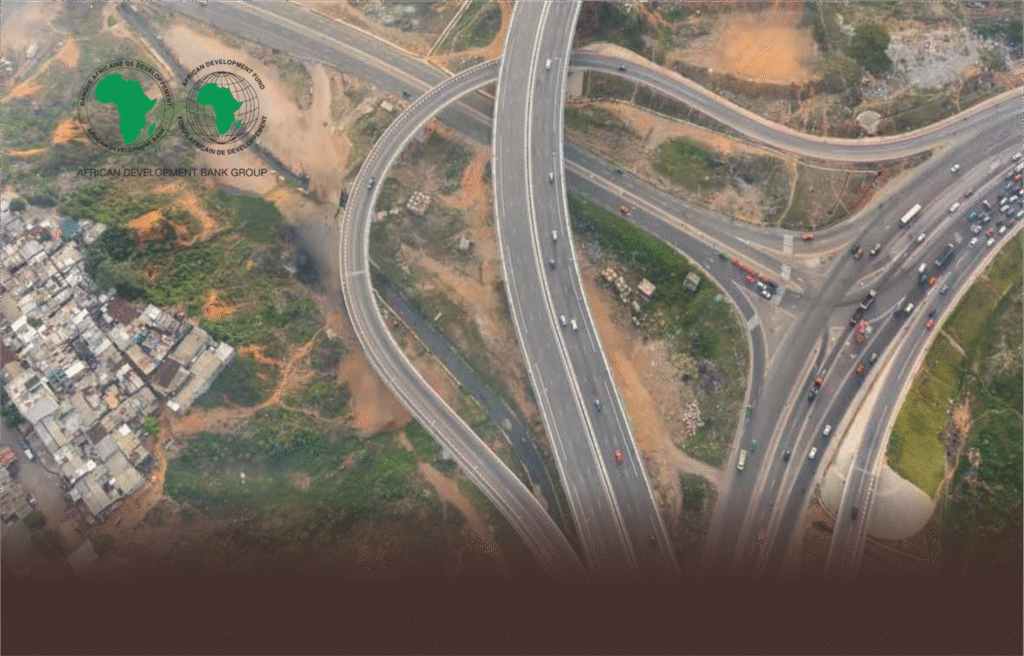

Infrastructure remains one of Africa’s most critical development challenges. Gaps in access to electricity, safe transport, and digital networks often limit opportunities for businesses and households. By lending to EAAIF, a Private Infrastructure Development Group (PIDG) company managed by investment firm Ninety One, the AfDB aims not only to fill financing shortfalls but also to catalyse broader social benefits.

The loan forms part of EAAIF’s larger debt-raising programme targeting $300 million in long-term financing in 2025, with a goal to invest more than $850 million in infrastructure across Africa and Asia by 2027. This is the Bank’s fourth loan to the Fund, signaling deepening confidence in the partnership’s ability to unlock private sector participation in sectors long considered too risky.

The human and social impact at the core, goes past the financial figures, as the bank emphasizes the real-world impact to, expanding access to electricity for rural communities, enabling reliable internet for schools and small businesses, improving road safety and market access, and supporting greener cities prepared for climate pressures. Mike Salawou, Director of Infrastructure and Urban Development at the AfDB said – “These projects are ultimately about people. Partnering with EAAIF allows us to unlock long-term financing for critical projects that power economies, create jobs, and improve lives across Africa. It also helps close the continent’s infrastructure financing gap by attracting private capital to high-impact projects in emerging and frontier markets.”

In a continent where youth unemployment and uneven development remain politically sensitive, the infrastructure push also carries social and political weight. Governments increasingly view sustainable infrastructure as a pathway to stability, as improvements in transport, energy, and digital services help ease social pressure, stimulate entrepreneurship and enhance trust in public institutions.

The AfDB’s investment reinforces an important political message – Africa’s development priorities are moving toward climate-smart growth. Renewable energy and climate resilience are central to the Fund’s pipeline, reflecting both national policy commitments and Africa’s vulnerability to climate change.

The international investors’ perspective, perceive the partnership as a growing confidence in Africa’s infrastructure market. By taking an early, risk-sharing position, the AfDB helps de-risk pioneering projects, encouraging private financiers who would otherwise stay away due to perceived instability or inadequate returns. Sumit Kanodia, Director at Ninety One, welcomed the strengthened collaboration, saying – “This loan will enable us to finance more renewable energy, digital, and transport projects that drive inclusive growth, create jobs and build climate persistence in the region”. A projected step forward in the midst of some hanging challenges.

While the loan represents progress, Africa still faces an annual infrastructure financing gap estimated in the tens of billions. Bridging this divide will require sustained cooperation between public institutions, development banks and private funders, alongside transparent governance and community-centered project design.

Still, with initiatives like this, the continent edges closer to infrastructure that not only supports economic ambition but also responds to social needs and strengthens political resilience.