African Economic Weekly Panorama: Brief Features on Growth, Governance and Society

Nigeria

Nigeria’s economy this week reflected a mix of external shocks, reform-driven policy shifts, and cautious optimism about long-term growth. From trade losses linked to global politics to investments aimed at supporting small businesses and digital inclusion, the developments underline how economic decisions translate into everyday realities for citizens.

Trade Pressures and Global Politics

Nigeria recorded an estimated ₦1 trillion export loss to the United States following the impact of renewed Trump-era tariffs. Exports fell by about 20.5% year-on-year, reversing a trade surplus that once favoured Nigeria. In regards to exporters, especially in agriculture and energy-related value chains, this decline means reduced income, job pressure, and weaker foreign exchange earnings. Politically, the figures revive debates around trade diversification and Africa’s vulnerability to policy shifts in major economies, reinforcing calls for stronger intra-African trade under the AfCFTA framework.

Budgets, Governance and Public Confidence:

The National Assembly’s approval of revised budgets of ₦43.5 trillion (2024) and ₦48.316 trillion (2025) signals legislative alignment with the executive on fiscal direction. By scheduling President Tinubu’s ₦58.47 trillion 2026 budget for debate, lawmakers are attempting to show continuity and planning. As for most citizens, these budgets shape spending on infrastructure, salaries, healthcare and education, are key areas that directly affect living standards and public trust in governance.

Tax Reform and Everyday Transactions

The decision to make the National Identification Number (NIN) automatically serve as a Tax Identification Number reflects a push to simplify Nigeria’s tax system. To ordinary Nigerians, this could reduce bureaucracy and confusion in banking and business transactions. Socially, it also raises questions about data protection and inclusion, especially for informal workers who have historically remained outside the tax net.

Capital Markets and Investor Protection

The SEC’s directive for capital market operators to renew registrations by January 2026, alongside plans for electronic submissions, highlights regulatory tightening and digitalisation. This directive aims to protect investors, boost transparency and modernise Nigeria’s financial markets, as critical steps for attracting both local savings and foreign investment.

Support for Small Businesses and Jobs

A major boost came with the World Bank’s $500 million financing package for Nigerian MSMEs. Small businesses employ a large share of Nigeria’s workforce, so improved access to credit can translate into job creation, poverty reduction, and youth entrepreneurship. Politically, the initiative aligns with broader promises of inclusive growth rather than elite-driven development.

Energy Transition and Industrial Policy

Nigeria’s MoU with China to localize CNG and electric vehicle infrastructure reflects a strategic shift toward cleaner, cheaper transport energy. Apart from climate benefits, the deal promises skills transfer, local manufacturing jobs and reduced fuel costs, linking environmental policy with social and economic outcomes.

Fiscal Health and Economic Stability:

Despite a ₦2.66 trillion fiscal deficit in Q2 2025, Nigeria remained within the ECOWAS 3% of GDP benchmark. Economic growth of 4.23% suggests resilience, though rising debt service costs continue to squeeze public finances. For citizens, this balance determines how much government can spend without worsening inflation or future tax burdens.

Foreign Exchange Flows and Currency Confidence

Nigeria’s net forex inflow rose 12% to $41.73 billion, offering some relief for currency stability. However, recent quarterly declines highlight ongoing dependence on volatile inflows. Exchange rate stability remains crucial for import prices, inflation, and household purchasing power.

Digital Connectivity and the Future Economy

Finally, talks with Google on a new undersea cable point to Nigeria’s ambition to become a regional digital hub. Improved connectivity would support startups, education, remote work, and access to global markets, while reducing risks from infrastructure failures.

The flow of developments indicate that Nigeria is navigating a complex intersection of global politics, domestic reform and social needs. While challenges still remain especially around trade shocks and debt, the emphasis on inclusion, digital infrastructure and small business support suggests a policy direction that increasingly links economic strategy with human impact.

Ghana

Ghana took notable steps this week to align economic reform with everyday realities, combining digital innovation, financial regulation, and international cooperation to steady its economy and widen opportunity for citizens.

Crypto Regulation Meets Real-Life Use

Parliament’s decision to formally legalize and regulate cryptocurrency marks a turning point in how Ghana manages fast-growing digital finance. By introducing a licensing and oversight framework for virtual asset service providers, authorities aim to protect users from fraud while calming central bank concerns over financial stability. For young people, freelancers, and small traders already using crypto for payments and remittances, the law offers legitimacy and clearer rules. Politically, it signals Ghana’s intent to modernise financial governance rather than ban innovation, positioning the country as a cautious but open player in Africa’s digital economy.

Making Policy Human Through Technology

The launch of a government-backed entrepreneurship policy chatbot reflects a practical approach to reducing red tape. To startups and small business owners who are often frustrated by unclear regulations, the chatbot provides instant, plain-language guidance on compliance and policy requirements. This improves access to information beyond Accra, supports digital inclusion, and lowers the cost of doing business. Socially, it empowers informal and first-time entrepreneurs, while politically it reinforces a reform agenda focused on transparency and service delivery.

IMF Adjustments and Economic Breathing Space

The IMF’s plan to revise Ghana’s fiscal and monetary targets under the Extended Credit Facility acknowledges the pressures facing the economy. By adjusting benchmarks on revenue, deficits, and inflation bands, the Fund aims to keep reforms realistic and avoid excessive strain on households. For citizens, this could mean fewer abrupt austerity shocks and more gradual stabilisation. At the political level, the revisions highlight ongoing negotiations between national priorities and external oversight, as Ghana works to restore confidence while protecting social stability.

Together, these developments show Ghana balancing reform with inclusion that is regulating new financial tools, simplifying governance for entrepreneurs and recalibrating international commitments. The common thread is an effort to make economic policy more responsive to people’s daily lives while strengthening institutions for long-term resilience.

Togo

Togo’s economic agenda this week combined fiscal planning, small-business support, and renewed dialogue with the private sector, highlighting efforts to link institutional reform with everyday livelihoods.

Bigger Budget, Broader Social Impact

The Senate’s approval of the 2026 budget of CFA2.75 trillion, a near 13% increase from 2025, marks a key step in Togo’s evolving governance framework. With revenues and spending aligned between the Senate and National Assembly, the budget gives the government room to invest more in growth, social services, and economic stability. For citizens, higher allocations can translate into improved infrastructure, public services, and job creation. Politically, the process underscores stronger institutions and legislative continuity, reinforcing confidence in public finance management.

Listening to Small Businesses Nationwide

Togo’s nationwide outreach by its MSME development agency reflects a shift from top-down policy to grassroots engagement. By touring major cities, officials are gathering direct feedback from entrepreneurs while explaining tools that help businesses access markets, financing and government programmes. The micro and small enterprises, which some are mostly family-businesses and community-based establishments, this approach reduces information gaps and gives them a voice in policy design. Socially, it supports inclusion by reaching businesses outside the capital and formal networks.

Rebuilding Trust on Taxes

Dialogue between the tax authority and private sector leaders signals an effort to ease long-standing tensions around compliance and audits. By clarifying rules, procedures, and recent reforms, both sides aim to improve voluntary compliance and reduce disputes. For businesses, clearer tax administration lowers uncertainty and costs; for the state, stronger cooperation supports sustainable revenue without stifling growth. Politically, the talks reflect a more consultative approach to reform.

Overall, Togo is aligning fiscal expansion with institutional maturity and private-sector inclusion. By pairing a larger budget with outreach to entrepreneurs and improved tax dialogue, policymakers are attempting to ensure that growth plans are not only technically sound but socially grounded, strengthening trust between the state, businesses and citizens.

Liberia

Liberia’s economic story this week highlighted how digital reform and fiscal discipline intersect with trust, inclusion, and democratic accountability, as authorities pushed forward on payments innovation while confronting rising public debt.

Instant Payments and Everyday Inclusion

The Central Bank of Liberia’s launch of a national instant payments system powered by Mojaloop represents a major shift in how money moves across the economy. By linking mobile money operators and banks in real time, the platform reduces dependence on cash and shortens delays in transactions such as salaries, remittances, and social welfare payments. The ordinary Liberians, mostly in rural areas and the informal sector, would see faster/interoperable payments system as means to safer transactions and easier access to financial services. Politically, the reform signals commitment to digital governance and aligns Liberia with regional efforts to modernise payments infrastructure.

Digital Reform with Social Impact

Beyond efficiency, the new system supports financial inclusion by lowering barriers for small traders, women-led businesses, and young entrepreneurs who rely heavily on mobile money. Faster payments can improve household cash flow and strengthen confidence in formal financial channels, helping integrate more citizens into the national economy.

Debt, Media Arrears, and Public Trust

At the same time, the government’s statement that settling media arrears is a legal obligation underscores the fiscal pressures facing the state as public debt approaches US$2.7 billion. By framing payments to media organisations as a statutory duty rather than a discretionary choice, authorities are signaling respect for rule-based public finance. For media houses, clearing arrears is essential to sustainability and press freedom; for citizens, it reinforces transparency and accountability in how public funds are managed.

Balancing Credibility and Stability

Officials stressed that prioritizing debt service is key to restoring fiscal credibility with domestic and external creditors. While this can constrain spending in the short term, it is presented as necessary to stabilise the economy and rebuild trust in government commitments.

This is an indication of that Liberia is balancing innovation with responsibility, using digital payments to widen inclusion and efficiency, while confronting debt challenges through adherence to legal and fiscal rules.

Mali

Mali’s economic developments this week reflected both assertive resource nationalism and the human cost of insecurity, as the government moved to reclaim mining revenues while relying on regional allies to ease a deepening fuel crisis.

Mining Reform and Public Revenue

Mali’s recovery of more than US$1.2 billion in unpaid mining arrears marks a major outcome of its new mining code and sector-wide audit. By raising royalties, increasing state participation, and removing long-standing stability clauses, the authorities are seeking to ensure that mineral wealth delivers greater public benefit. For citizens, the recovered funds represent potential investment in public services, salaries, and basic infrastructure at a time of fiscal strain. Politically, the move strengthens the military-led government’s narrative of economic sovereignty and tougher oversight of multinational companies.

Social Stakes of Resource Nationalism

While the reforms promise higher state revenues, they also reshape relations with foreign investors, raising questions about long-term investment flows. For local communities near mining sites, stronger state involvement could mean better social spending and environmental oversight—if revenues are transparently managed. The challenge remains converting fiscal gains into visible improvements in daily life.

Fuel Convoys and Human Resilience

The arrival of 82 fuel tankers from Niger after a 21-day journey highlights the severity of Mali’s fuel shortage and the resilience of regional cooperation. Blockades by armed groups have disrupted supply chains for more than two months, affecting transport, electricity generation, food prices, and access to essential services. For households and small businesses, fuel scarcity has translated into higher costs and economic disruption.

Politics, Security, and New Alliances

Support from Niger and commitments from Russia to supply petroleum and food underscore Mali’s shifting geopolitical alignments. Within the Alliance of Sahel States, Mali, Niger, and Burkina Faso are seeking collective security and alternative economic lifelines amid ongoing insurgency. Politically, these partnerships reflect a move away from traditional allies and toward new sources of support, even as insecurity continues to shape economic outcomes.

The mining revenue recovery and emergency fuel support reveal a country balancing economic assertion with crisis management. Mali’s challenge now lies in turning reclaimed resources and new alliances into stability and tangible social gains for its population.

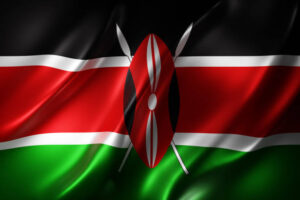

Kenya

Nairobi County Introduces Paid Menstrual Leave for Women

Nairobi County has taken a socially progressive step by approving a policy that grants female employees two paid days off each month for menstrual health, without drawing on sick or annual leave. By formally recognizing menstrual pain, fatigue, and related health challenges as legitimate workplace concerns, the policy elevates dignity and wellbeing in public employment. Advocates say the move acknowledges a reality long ignored in formal labour policies and could improve productivity by reducing presenteeism and stress. Politically, it signals a willingness by county leaders to advance gender-responsive governance and normalize conversations around women’s health. Critics caution that the policy could unintentionally reinforce stereotypes or influence hiring practices, but supporters argue that transparent safeguards and public education can mitigate these risks. The decision positions Nairobi as a national frontrunner in integrating menstrual health into labour rights, with potential ripple effects across Kenya’s public and private sectors.

PowerGen Raises US$50m to Expand Renewable Energy in Kenya

Clean energy developer PowerGen has raised US$50m to scale renewable power projects across Kenya and several African markets, reinforcing the country’s role as a hub for green innovation. The investment will support the development of 120 MW of capacity, bringing reliable electricity to around 68,000 households and 7,000 businesses through mini-grids, metro-grids, and battery storage systems. Away from climate benefits, the expansion promises tangible human gains, longer business hours, improved healthcare delivery, better school outcomes and new jobs in construction and maintenance. Backed by investors including InfraCo Africa, IFU, EDFI ElectriFi, and the African Development Bank, the project also reflects growing political and financial confidence in decentralized energy models. By aligning with global climate and development goals, PowerGen’s approach offers a scalable pathway for reducing energy poverty while supporting inclusive economic growth.

Kenya Licenses Safaricom and Airtel Money to Expand Digital Trading

Kenya’s financial landscape is set for a major shift after the Capital Markets Authority licensed Safaricom and Airtel Money as Intermediary Service Platform Providers. The move allows millions of mobile money users to access regulated capital markets directly from their phones, lowering long-standing barriers to investment. Safaricom plans to integrate trading features into M-PESA, enabling participation with as little as KES 100, while Airtel Money will roll out similar services. Regulators say the initiative could unlock household savings, deepen financial inclusion, and strengthen domestic capital formation. Socially, it broadens wealth-building opportunities beyond urban elites, giving ordinary citizens a stake in Kenya’s economic future. Politically, it underscores the state’s commitment to digital innovation as a development tool, reinforcing Kenya’s reputation as a continental leader in mobile finance and inclusive growth.

![]()

Ethiopia

China Donates Motorcycles to Ethiopian Police

China has donated dozens of motorcycles and police uniforms to the Ethiopian Federal Police Commission, strengthening everyday security and traffic management in major cities and on key highways. Beyond improving VIP protection and escort services, the motorcycles are expected to ease congestion and enhance safety for ordinary commuters, especially during large national and international events at the African Union headquarters in Addis Ababa. For frontline officers, the equipment means faster response times and safer working conditions. Politically, the gesture reinforces China’s visible security cooperation with Ethiopia, highlighting a partnership that extends beyond infrastructure into public safety. Socially, improved traffic flow and policing can reduce accidents, save time for workers and traders, and support Addis Ababa’s role as Africa’s diplomatic capital.

Ethiopia and Kenya Boost Cross-Border Trade

Ethiopia and Kenya have signed a Simplified Trade Border Regime aimed at cutting red tape and lowering costs for small-scale traders along their shared border. The agreement is designed to make customs procedures faster and more predictable, directly benefiting women and informal traders who rely on cross-border commerce for livelihoods. By easing movement of goods, the deal supports food security, local employment, and price stability in border communities. Politically, it signals renewed commitment to regional integration and practical implementation of the African Continental Free Trade Area (AfCFTA). The move strengthens economic diplomacy between the two neighbours while grounding continental ambitions in tangible, people-centred outcomes.

Ethiopia’s Birr Falls to Third-Weakest Currency

The Ethiopian birr has fallen more than 15% against the U.S. dollar in 2025, making it one of the weakest-performing currencies globally. As for many households, the depreciation is felt through higher prices for imported food, fuel, and medicine, intensifying cost-of-living pressures. For businesses, it raises uncertainty and import costs, even as exporters gain some competitiveness. The slide reflects persistent inflation, foreign exchange shortages, and investor caution as Ethiopia pursues debt restructuring and a US$3.4bn IMF-supported reform programme. Politically, the reforms ranging from forex liberalization to privatization, are a delicate balancing act between restoring macroeconomic stability and protecting vulnerable citizens from short-term shocks.

Egypt Upgrades Regional Ports, Raising Pressure on Ethiopia

Egypt’s planned expansion of Eritrea’s Asab port and Djibouti’s Doraleh port has added a new layer to regional geopolitics, with implications for landlocked Ethiopia. The upgrades strengthen Egypt’s military and logistical presence while increasing transport capacity along key Red Sea routes. For Ethiopia, which relies heavily on Doraleh for trade, the developments underscore its strategic vulnerability amid ongoing tensions over the Grand Ethiopian Renaissance Dam. Politically, the move reflects Egypt’s broader strategy of building regional alliances to protect its Nile interests. Ethiopia, for its part, continues to assert its right to operate the dam while navigating a complex diplomatic environment that directly affects trade costs and national security.

Ethiopia and the US Sign US$1.6bn Health Cooperation Deal

Ethiopia and the United States have signed a five-year, US$1.6bn health cooperation agreement aimed at strengthening the country’s health system and protecting millions of lives. The partnership focuses on disease prevention, public health surveillance, workforce training, and emergency preparedness, with particular attention to HIV/AIDS, malaria, tuberculosis, maternal and child health, and polio. For communities, the deal promises better access to care, stronger disease control, and improved resilience to health shocks. Politically, it signals renewed confidence in long-term cooperation and shared accountability, with funding tied partly to performance. Socially, the investment underscores health as both a human right and an economic foundation, supporting productivity, stability, and inclusive development across Ethiopia.

Zimbabwe

International Travel to Zimbabwe Rises Sharply in 2025

Zimbabwe has recorded a notable rebound in international travel, with foreign arrivals rising by 15% in the third quarter of 2025 to 520,751 visitors. Growth was driven largely by a surge in business travel, up 43%, alongside an 18% increase in leisure tourism. When returning residents are included, total arrivals reached 1.38 million, scoring a renewed regional free movement and confidence. Most visitors came from neighbouring African countries, led by South Africa, Mozambique and Zambia, highlighting Zimbabwe’s importance as a regional hub for trade, family ties and cultural exchange. In most local communities, rising migrational arrivals translated into jobs in hospitality, transport, crafts and food services, spreading income beyond major cities. Governmentally, the trend supports the government’s tourism-led growth strategy, which targets a US$10 billion sector by 2030 through infrastructure upgrades, heritage and cultural tourism, and more sustainable environmental policies. Socially, increased travel strengthens people-to-people connections and reinforces Zimbabwe’s image as open for business and tourism.

Zimbabwe Tightens Indigenization Rules for Foreign Businesses

The government has introduced stricter indigenization regulations requiring foreign-owned firms in 14 sectors, which are mainly services and retail sectors, in order to transfer 75% of equity to local citizens within three years or risk closure. Penalties for non-compliance include fines, potential imprisonment, and multi-year bans from operating in affected sectors. Authorities argue the policy is designed to deepen local participation in the economy, expand ownership opportunities, and ensure that profits circulate within communities. Supporters see it as a political statement of economic sovereignty and social justice, aimed at empowering citizens after decades of inequality. Critics, however, warn the rules could unsettle investors and complicate Zimbabwe’s efforts to attract foreign capital, even if many of the targeted sectors are already largely locally owned. The move highlights the ongoing tension between economic nationalism and investment-led growth, with significant implications for jobs, entrepreneurship, and Zimbabwe’s long-term development path.

Egypt

Egypt Cuts Key Interest Rates to Support Growth

The Central Bank of Egypt has cut its main policy rates by 100 basis points, lowering borrowing costs for banks, businesses, and households. Coming after cumulative cuts of 725 basis points in 2025, the move reflects growing confidence in easing inflation and improving currency conditions. For families and small enterprises, lower rates can mean more affordable loans, relief from debt pressures, and renewed spending power. Politically, the decision signals a shift from crisis containment toward growth management, as authorities try to balance price stability with job creation. Socially, easier credit conditions could support housing, education, and small business activity, helping translate macroeconomic stability into everyday economic relief.

Egypt Channels US$2.8bn to the Private Sector in 2025

Egypt has secured US$2.8bn in concessional financing for its private sector this year, reinforcing the government’s strategy of letting businesses drive growth and employment. Channeled largely through banks and financial institutions, the funds are supporting tourism, healthcare, manufacturing, transport and logistics sectors, with strong links to job creation and service delivery. Since 2020, total private-sector support has reached US$17bn, with more funding expected through European-backed guarantee mechanisms. The NWFE platform alone has mobilized US$5bn for renewable energy and grid projects, strengthening Egypt’s climate leadership while expanding clean power access. Politically, the financing underlines policy continuity and reform credibility; socially, it supports livelihoods by encouraging investment, skills development, and more resilient growth.

Egypt Moves to Standardize Export and Import Data

Egypt has signed new protocols to harmonies export and import data across government agencies, a technical reform with wide-reaching economic and social implications. By improving data accuracy and aligning with global standards, the government aims to strengthen investor confidence, improve trade policy decisions, and expand higher-value exports. For businesses, clearer and more reliable data reduces uncertainty and transaction costs, while for policymakers it supports better planning and accountability. The reform fits into Egypt’s Vision 2030 agenda, gesturing a political commitment to transparency and evidence-based governance that can attract foreign currency inflows and support long-term development.

Engineering Exports Gain Momentum in 2025

Egypt’s engineering exports rose by 13.9% in the first eleven months of 2025 to US$5.93bn, with a sharp 35.4% surge recorded in November alone. Growth has been driven by machinery, electrical equipment, automotive components, transport equipment, and home appliances, reflecting deeper industrial diversification. Expanding sales across Europe, Asia, Africa, the Arab world, and the United States point to stronger global integration of Egyptian manufacturers. For workers, rising exports mean more factory jobs and skill upgrading; for the economy, they bring in vital foreign currency. Politically and socially, the trend supports Egypt’s ambition to move up the value chain, shifting from reliance on raw materials toward more complex, job-rich industries.

South Africa

South Africans Lose US$120m to Online Scams

South African consumers reportedly lost around US$120 million to online scams over the past year, according to the South African Banking Risk Information Centre (SABRIC), though the actual figure may be higher due to underreporting. Scammers often impersonate retailers like Makro or Takealot, targeting people through SMS or email, particularly during the festive season and after online searches for popular electronics. Beyond the financial loss, these scams have significant social implications: victims may face stress, anxiety, and reduced trust in digital commerce. Politically, the trend highlights the need for stronger cybersecurity policies, consumer protection measures, and public education campaigns. Protecting citizens from fraud not only safeguards personal wealth but also supports confidence in the broader digital economy, which is increasingly central to South Africa’s post-pandemic growth strategy.

South African Court Cancels Eskom US$3.2bn Tariff Deal

A South African High Court has overturned a 54 billion-rand (US$3.2bn) settlement between Eskom and the National Energy Regulator (Nersa) over an electricity tariff miscalculation. The court criticised the deal’s lack of transparency and described it as “little more than a thumb-suck,” ruling that public participation must precede any final tariff adjustments. The rejected settlement would have raised electricity prices by 8.76% in 2026 and 8.83% in 2027, surpassing the Reserve Bank’s inflation targets and straining household budgets. The decision carries major human benefits, protecting consumers especially low/middle-income families from sudden price shocks. The ruling strengthens accountability and reinforces the importance of citizen engagement in regulatory processes from a politically standpoint. Socially, it underscores the principle that essential services like electricity should be set with public input, balancing economic sustainability with equity and social welfare.

Tanzania

Water Shortages Disrupt Holiday Season in Dar es Salaam

Dar es Salaam, Tanzania’s largest city, is grappling with severe water shortages, affecting residents and businesses during the Christmas holiday season. City authorities have implemented rationing, supplying water only once a week, while many households are forced to purchase water from expensive private vendors. The crisis stems from a combination of drought, rising urban demand, and aging, leaky infrastructure, with around 70% of the city’s water sourced from the rainfall-dependent Ruvu River. Newly developed suburbs and densely populated neighborhoods are hardest hit. For residents, the shortages mean adjusting daily routines, storing water in containers, and carefully planning household activities, while small businesses face operational challenges, including reduced hours and higher costs. Politically, the crisis puts pressure on municipal authorities to improve infrastructure, manage resources sustainably, and address citizen grievances. Socially, the water shortage underscores inequality, as low-income families are disproportionately affected, and highlights the urgent need for long-term water security solutions to support urban life and economic activity.

CBE Hosts Bank of Tanzania Delegation on Business Continuity

The Central Bank of Egypt recently hosted a delegation from the Bank of Tanzania to exchange knowledge on Business Continuity Management (BCM). Tanzanian experts in planning and management reviewed Egypt’s BCM practices, covering crisis response, cybersecurity, payment systems, and banking supervision. The initiative, highlighted by Naglaa Nozahie, advisor for African affairs to the CBE governor, strengthens cooperation between African central banks and allows participants to benefit from Egypt’s ISO 22301 certification in BCM. Beyond technical gains, such exchanges have human and social benefits: they enhance financial system resilience, protect consumers and businesses during crises, and build public confidence in banking operations. Politically, these programs foster regional collaboration, positioning African central banks as proactive actors in ensuring economic stability and inclusive growth across the continent.

![]()

Mozambique

Mozambique Tightens Telecom Traffic Rules to Boost Security

Mozambique has approved Decree No. 48/2025, updating telecom traffic regulations to combat cybercrime and strengthen national security. The National Communications Institute (INCM) can now monitor networks, while operators must provide CDR/IPDR data, detect fraud, conduct audits, and report suspicious activity within two hours. Service suspensions lasting more than 48 hours require judicial approval. Non-compliance carries fines of up to 3,500 public-sector salaries, doubled if state revenue is affected. Beyond regulatory enforcement, the decree has human and social benefits: it safeguards citizens from fraud, protects personal data, and improves trust in digital services, which are increasingly vital for business, education, and social communication. Politically, it demonstrates government commitment to security and good governance, while reinforcing Mozambique’s readiness to integrate into global digital economies.

Mozambique Secures US$75bn in Investment Promises

President Daniel Chapo informed parliament that Mozambique has secured US$75bn, three times the country’s annual GDP, in investment pledges, through active international diplomacy, including 27 foreign trips over 11 months. While only part of the funds is guaranteed, the commitments signal investor confidence in Mozambique’s long-term growth potential. To citizens, such investments can translate into infrastructure improvements, job creation and enhanced access to services. The pledges reflect the government’s proactive engagement on the international stage and its ability to leverage diplomacy for economic development politically. Socially, successful investment mobilization could reduce inequality, support local enterprises, and foster economic resilience across communities.

Mozambique Restricts Imports to Manage Currency Shortages

In response to a severe foreign currency shortage, Mozambique has limited imports of non-essential items such as bottled water, pasta, cement, maize flour, tiles, and salt. The government aims to prioritise essential goods, strengthen local industries, and ensure more efficient use of foreign exchange. These measures follow a cap on overseas bank card payments and will remain in effect for 12 months, with financial penalties for non-compliance. The policy has human and social implications: by promoting local production, it helps secure jobs, stabilises domestic prices, and increases the availability of basic goods for households. Politically, the approach signals a government willing to intervene in the economy to protect citizens’ welfare and preserve macroeconomic stability.

Post-Election Violence Costs Mozambique US$428m

President Chapo reported that Mozambique suffered 27.4 billion meticais (US$428m) in losses due to post-election violence from October 2024 to March 2025. The unrest destroyed 1,733 businesses, 399 public buildings, and critical infrastructure, including electricity pylons, mobile towers, and fuel pumps, resulting in around 50,000 job losses. The human costs were severe, affecting livelihoods, access to essential services, and community cohesion. Politically, the episode highlights the need for peaceful democratic processes and stronger conflict prevention mechanisms. Socially, rebuilding will require public-private collaboration to restore infrastructure, generate employment, and support affected families, underlining the importance of stability as a foundation for sustainable development.

Africa in General

AfDB Approves US$214.4m for South Sudan–Ethiopia–Djibouti Transport Corridor Phase II

On December 3, 2025, the African Development Bank approved US$214.47m for Phase II of the South Sudan–Ethiopia–Djibouti Transport Corridor Project, including US$181.5m for Ethiopia, US$29.71m for Djibouti, and US$3.26m for South Sudan, with US$1.3m coming from the Bank’s Transition Support Facility. The project will upgrade a 67-km expressway and introduce intelligent transport systems in Ethiopia, improve the 18-km Dikhil–Mouloud section in Djibouti, and conduct feasibility studies for 280 km of road in South Sudan, along with feeder roads. Beyond improving trade connectivity, the project promises direct human benefits: reduced travel times, safer roads, improved access to markets, healthcare, and education, and enhanced livelihoods for communities along the corridor. Politically, the initiative strengthens regional cooperation and integration, aligning with continental infrastructure goals under the African Union’s Agenda 2063. Socially, it creates employment during construction, supports small businesses through better logistics, and fosters people-to-people connections across borders, enhancing stability and shared prosperity.

Burkina Faso, Mali, and Niger Launch Sahel Regional Force

Burkina Faso, Mali, and Niger have inaugurated a 5,000-strong Sahel regional force aimed at countering Islamist insurgencies and other security threats. The ceremony, held in Bamako and presided over by Mali’s army ruler General Assimi Goita, established the force’s command base in Niamey under Burkinabe General Daouda Traoré. The initiative represents deeper military integration among the three countries, all governed by juntas, and follows their withdrawal from ECOWAS in response to sanctions and perceived interference. Beyond security, the force carries human and social dimensions: it seeks to protect civilian populations, reduce displacement caused by attacks, and create a more stable environment for local economic activity. Politically, it signals a drive for regional autonomy in security matters, while socially, it underscores the importance of collective action to safeguard communities and enable development in one of Africa’s most fragile regions.

Inspired by: Proshare