RECAP: Société Générale Mauritania Secured New Financing Agreement

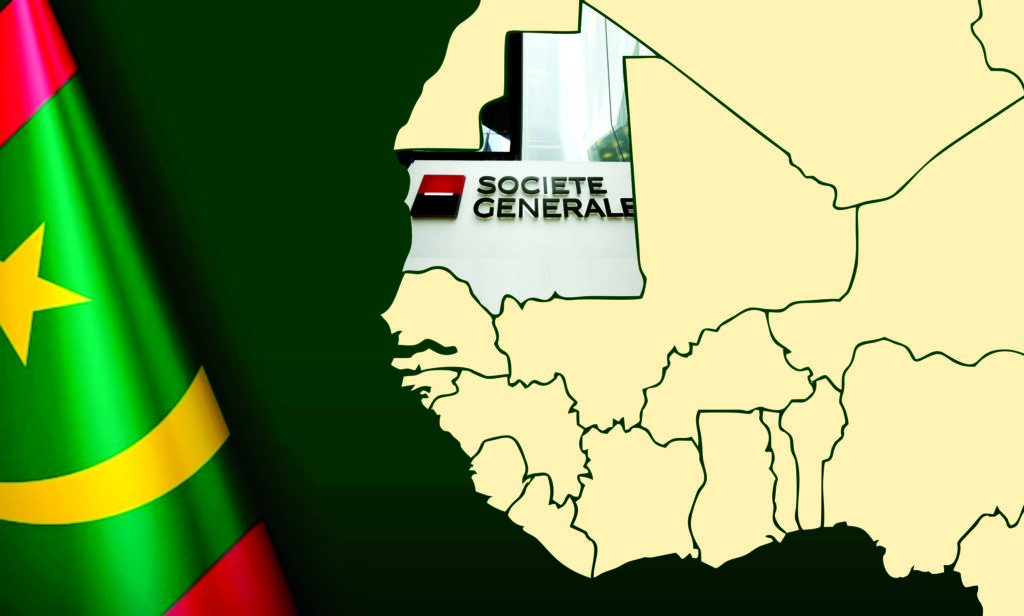

As part of its strategic pullback from the continent, Société Générale placed its Mauritanian subsidiary, Société Générale Mauritanie (SGM) on the market, which is another chapter in a wider retrenchment by European banks from Africa’s smaller economies. In August 2025, the exit became official when a consortium led by Enko Capital, controlled by the Nkontchou brothers, alongside Oronte, the founder’s investment company, completed the full acquisition of SGM.

The sale reflects a recalibration toward core markets and reduced exposure to jurisdictions where scale is limited and regulatory costs are rising for Société Générale group. While to the buyers, it signals a stake on local knowledge and patient capital. Enko Capital has built a reputation for investing in African financial institutions, often positioning itself as a long-term partner rather than a short-term trader.

The transition carries human and social implications beyond balance sheets. Employees and customers have faced months of uncertainty, while regulators and businesses are watching closely to see whether local ownership will translate into expanded credit for small firms and households. An enduring gap in Mauritania’s economy.

The deal could strengthen financial inclusion and decision-making rooted closer to the market If managed well. If not, it risks reinforcing concerns about continuity, governance, and access.

In the meantime, the acquisition highlights a broader shift showing that as global banks step back, regional investors are stepping in to redefine Africa’s banking landscape from the ground up.