IMF Forecasts 3.3% Global Growth in 2026, Citing Economic Strength Despite Rising Geopolitical Risks

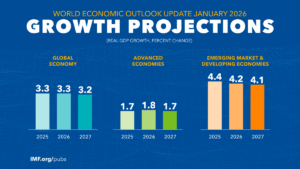

Against a backdrop of trade tensions, wars, and a global economy still adjusting to higher interest rates, the International Monetary Fund (IMF) is striking a cautiously optimistic note. In its January 2026 update of the World Economic Outlook, the Fund now expects the global economy to grow by 3.3 percent in 2026, up from the 3.1 percent it projected just three months earlier.

The upward revision is modest, but significant. It reflects what IMF economists describe as a surprising degree of resilience, from boardrooms and factory floors to family-owned shops, driven by a surge in technology investment, particularly in artificial intelligence, alongside supportive government policies and a private sector that has learned to adapt quickly to uncertainty. A recovery built on adaptation.

Behind the aggregate numbers are millions of individual adjustments. Businesses that weathered pandemic shutdowns, supply-chain disruptions, and inflation spikes have become leaner and more flexible. Many have turned to automation, data analytics, and AI-powered tools to cut costs, manage inventories and reach customers in new ways. “In many economies, firms have stopped waiting for stability to return”, a senior IMF official said during the briefing. “They are investing through uncertainty, not despite it”.

![]()

This adaptability is one of the core reasons the IMF believes growth can hold up even as trade policy headwinds intensify. New tariffs, export controls and industrial policies, especially among major economies, are reshaping global commerce. While these shifts add friction, the IMF argues that for now technology and policy support are compensating.

The headline growth figure masks deep disparities. The IMF projects advanced economies to grow by about 1.8 percent in 2026, weighed down by aging populations, tighter fiscal space, and slower productivity gains. By contrast, emerging market and developing economies are expected to expand at rates above 4 percent, driven by demographics, urbanization, and investment catch-up.

This divergence is tangible for families. In wealthier countries, many households continue to feel squeezed by high housing costs and lingering price pressures, even as inflation cools. In parts of Africa, Asia and Latin America, faster growth is creating jobs, but often in informal sectors with limited social protection. “These numbers don’t automatically translate into better living standards” said an economist based. “Growth without inclusion can still leave families struggling”.

Artificial intelligence sits at the center of the IMF’s optimism and its caution. Investment in AI infrastructure, software and skills is acting as a powerful tailwind, particularly in the United States and parts of Asia. The Fund sees potential for major productivity gains if AI is widely and effectively adopted.

But the risks are equally clear. If expectations around AI prove overblown, or if adoption stalls due to skills gaps, regulation, or public resistance, the growth dividend could disappoint. There are also social concerns: job displacement, widening inequality between high/low skilled workers, and fears about data privacy and control.

In some communities, these debates are already playing out at the grassroots level, as workers demand retraining and unions push for safeguards. “Technology can’t just be about profits. It has to work for people” said a labor organizer in Berlin.

Geopolitical tensions remain the biggest downside risk in the IMF’s outlook. Conflicts, diplomatic rifts, and election-driven policy swings could disrupt energy markets, investment flows, and fragile supply chains. A sharp escalation, the Fund warns, could quickly derail growth.

To navigate these risks, the IMF is urging governments to act on several fronts: rebuild fiscal buffers strained by years of crisis spending, keep inflation under control, reduce policy uncertainty, and pursue structural reforms that boost productivity and inclusion.

![]()

These recommendations are as political as they are economic. Cutting deficits can be unpopular. Structural reforms often challenge entrenched interests. Yet, the IMF argues that delaying action could leave countries more exposed when the next shock hits.

Looking ahead to 2027, the IMF expects global growth to ease slightly to 3.2 percent, suggesting that today’s resilience is not guaranteed. The world economy, in the Fund’s assessment, is walking a narrow path, supported by innovation and adaptability, but vulnerable to missteps in policy, politics, or technology.

The global economy is holding up better than feared, but the hard work of turning growth into broad-based prosperity is far from over.