West African Development Bank (BOAD) Unveils 2026–2030 Strategy, Targeting Grassroots Growth Across West Africa

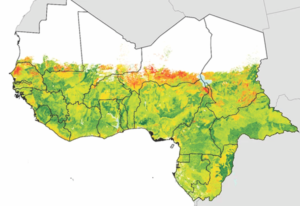

In a move that signals both financial ambition and social urgency, the West African Development Bank (BOAD) has launched its 2026–2030 strategic plan, pledging to deepen infrastructure investment, expand energy access, and strengthen food security across the eight member states of the West African Economic and Monetary Union (WAEMU).

The plan follows the completion of BOAD’s 2021–2025 “Djoliba” strategy, which surpassed expectations by achieving 107.4% of its targets and mobilizing more than $5.2 billion in commitments. Officials say the new five-year roadmap will move beyond macro-level financing figures to focus more directly on community-level impact. Connecting rural farmers to markets, improving electricity access for small businesses and strengthening regional supply chains. From paper-work of balance sheets to impact on families.

Essentially, the 2026–2030 strategy prioritizes four pillars: infrastructure, energy transition, agriculture, and private sector development. While those categories may sound technical, their implications are extremely human. In energy, BOAD plans to accelerate renewable projects that could reduce chronic power shortages affecting small enterprises and households. In agriculture, the bank’s recent decision to join the Global Alliance Against Hunger and Poverty signals a political and moral commitment to tackling food insecurity that has intensified within climate volatility and global price shocks. Development analysts noted that these investments could have ripple effects, by improving rural roads, which can reduce post-harvest losses; renewable mini-grids can power local processing facilities; and structured financing can help small and medium-sized enterprises expand beyond subsistence levels.

Focusing on financial confidence at regional leverage, the strategy also reflects growing international confidence in the regional lender. From late 2025 to date, BOAD raised its largest issuance, €1 billion through a 15year bond on the international market. The oversubscribed bond strengthened its capital base, also positioned the institution as a credible bridge between global capital markets and West African development needs.

To further enhance its financing toolkit, BOAD has increased its sovereign portfolio credit insurance to XOF297.6 billion (approximately €454 million), expanding its risk-bearing capacity and enabling it to support larger and potentially more transformative projects.

Meanwhile, the creation of BOAD Market Solutions, which is a new structured finance and advisory subsidiary, marks a strategic shift in their business services. By appointing Adji Sokhna M’Baye as CEO in February 2026, the bank indicated its intent to professionalize project preparation and attract private investment into sectors traditionally seen as high-risk. Observers say this could help crowd-in domestic and international investors, particularly in infrastructure and agribusiness; even with the political significant transition in a changing region. The new strategic plan arrives at a politically sensitive moment for West Africa. Economic growth across the WAEMU bloc has been uneven; and governments are under mounting pressure to deliver jobs, energy security and price stability.

Under the leadership of President Serge Ekué, BOAD has emphasized securing investment-grade ratings while expanding its development footprint. The bank’s leadership argues that strong governance and financial discipline, are essential tools to ensure that development funds translate into tangible public goods. By strengthening its capital structure and aligning with global anti-poverty initiatives, BOAD is also reinforcing WAEMU’s collective bargaining power in the international financial circles, as an important diplomatic beacon towards shaping development priorities.

However, to many West Africa citizens, success will not be measured in bond yields or portfolio insurance figures. It will be seen in villages supplied with electricity, accessible farm credit, improved roads and creation of jobs for young entrepreneurs. While some civil society groups across the region have welcomed the emphasis on agriculture and private sector support, they urge for transparency and community consultation in project selection. Some economists also stress that effective implementation will require coordination with national governments and local authorities, to ensure that financing addresses real-time constraints.

As BOAD embarks on its 2026-2030 journey plan, the presumed challenge will be to balance financial innovation with social inclusion and translating institutional strength into inclusive growth that reaches both urban centers and rural communities. And if the Djoliba plan proved the bank could exceed targets, the next five years will test whether it can convert financial momentum into lasting human development across West Africa.