African Countries to Emerge as Biggest Economies by 2030 and the Key Economic-facilitating Dimensions

By 2030, Africa’s economic map is expected to look both familiar and strikingly new. Familiar because a core group of large economies like Nigeria, South Africa, Egypt and key North African states are projected to remain dominant. New because the forces driving their rise are no longer limited to oil, minerals, or raw population size, but increasingly shaped by technology, industrial policy, regional trade and grassroots entrepreneurship.

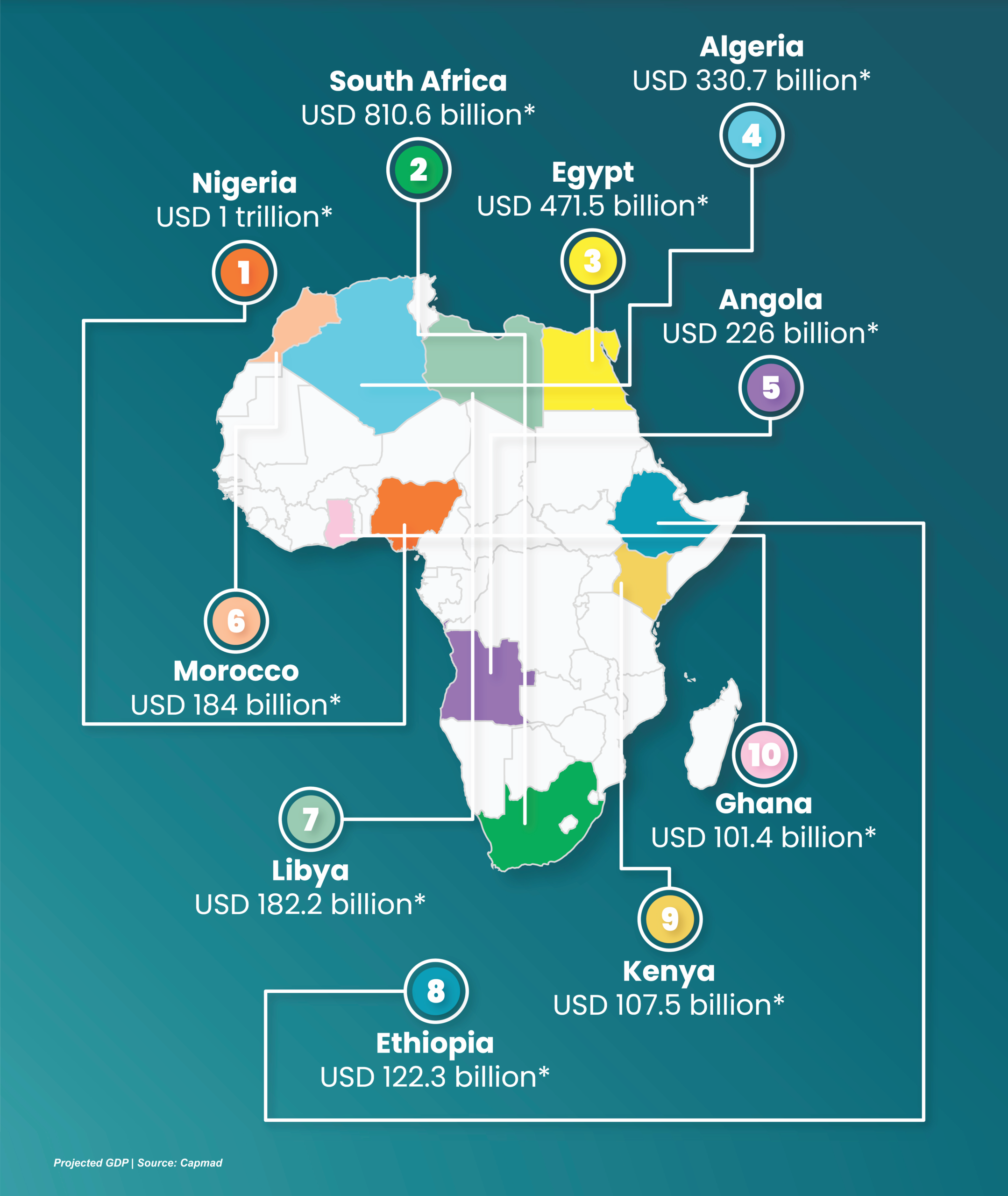

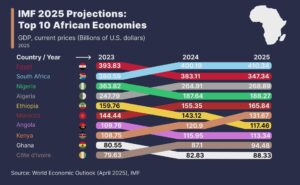

Based on forecasts from the International Monetary Fund (IMF), the World Bank and other financial institutions for the 2026-2030 period, Africa’s largest economies are emerging through a blend of scale and structural change. The race to the top is not simply about who posts the biggest GDP figures, but about who successfully transforms growth into jobs creation, economic flexibility and shared prosperity. The likely Africa economic leaders by 2030 would drive the frontal-representation for global negotiations.

While rankings vary slightly across projections, there is broad agreement on the countries expected to anchor Africa’s economy by the end of the decade. Nigeria, South Africa and Egypt consistently appear at the top, joined by a cluster of fast-growing economies in the North, West, East and Southern Africa.

Nigeria with the Scale Advantage: Nigeria is widely forecast to either remain or become Africa’s largest economy by 2030, with some projections placing it on a path toward a $1 trillion GDP. Its advantage lies in the scale of being Africa’s largest population, as a rapidly expanding consumer market, fast growing human capital index, explosive culture-export features, a dynamic services sector, dogged intelligent youth ecosystem, entrepreneurial zest regardless of enabling environment, ambitious-drive for education, abundant natural resources, etc.

Apart from oil, Nigeria’s fintech ecosystem, creative industries, telecommunications, and retail economy are reshaping how growth is generated. Startups in Lagos and Abuja are attracting global capital, while digital payments and mobile banking are pulling millions into the formal economy. Besides, Nigeria’s rise also highlights governance challenges in areas such as power supply, infrastructure gaps, inflation, jobs creation, youth development, etc., that will determine whether the projected growth translates into broad-based development.

Egypt, the Strategic Connector: Egypt’s economic weight is reinforced by geography and policy. Control of the Suez Canal makes it a strategic trade artery between Africa, Europe and Asia. Tourism, manufacturing, construction, and energy reforms continue to underpin growth.

Large-scale infrastructure projects and industrial zones have boosted output, but they also raise questions about debt sustainability and social equity. Egypt’s challenge by 2030 will be balancing state-led expansion with private-sector dynamism and job creation for a young population.

South Africa, an Industrial Anchor: South Africa remains one of Africa’s most diversified and industrialized economies, with advanced financial markets, deep capital pools, and strong mining and manufacturing sectors. Growth has been slower than peers, constrained by energy shortages, inequality and governance concerns.

Still, South Africa’s institutional depth, corporate base and leadership in green energy and finance, position it as a critical hub for the continent, with less rapid expansion, more focus on stability, innovation and regional influence.

North Africa’s Pillars – Algeria and Morocco: Algeria and Morocco are projected to remain among Africa’s top economies, though with different models. Algeria continues to rely heavily on hydrocarbons, using energy exports to fund public spending while cautiously exploring diversification.

Morocco by contrast, has built a more diversified economy with automotive manufacturing, aerospace, agriculture, renewable energy and trade links with Europe and West Africa. Its industrial strategy offers a blueprint for middle-income African economies seeking to climb global value chains. The fast growers would redefine economic power in the nearest future.

Furthermore, beyond the projected giants, several countries that are emerging as high-growth contenders, are reshaping regional balances on the projection-indicator.

Ethiopia with Manufacturing and Infrastructure Push: Ethiopia stands out as one of Africa’s fastest-growing economies. Heavy investment in infrastructure like railways, industrial parks and energy projects, has supported a push into manufacturing and agro-processing.

If political stability holds, Ethiopia’s transition from agriculture-led growth to light manufacturing could make it one of the continent’s most transformative economic stories, even if its GDP remains smaller than Nigeria’s or Egypt’s by 2030.

Kenya on the Digital Frontier: Kenya has earned its reputation as the Silicon Savannah. Mobile money, fintech and digital services are anchored by innovations like M-Pesa, MoMo, etc., which have redefined financial inclusion and entrepreneurship across East Africa.

By 2030, Kenya’s strength would be less about raw GDP size and more about influence; setting standards in technology, finance and regional integration, while acting as a gateway for investment into East and Central Africa.

Ghana, Côte d’Ivoire, Angola and the DRC Focus: Ghana and Côte d’Ivoire continue to drive West African growth through services, cocoa, energy and improving governance frameworks. Angola remains a major oil economy, seeking diversification after years of volatility.

Meanwhile, the Democratic Republic of Congo looms as a long-term wildcard. With vast mineral wealth critical to the global energy transition, the DRC has the potential to become an economic giant like some others, if infrastructure, governance and security challenges are addressed. These and more are some of the projection-indicator of the economic dimensions shaping the Africa’s rise. And what unites Africa’s projected countries’ economic leadership is not just size, but the sectors redefining growth across the continent, some which are:

Digitalization and Fintech: Mobile technology and fintech are expanding financial access at unprecedented speed. From Kenya’s mobile money systems to Nigeria’s fintech startups, digital platforms are formalizing economies from the bottom up.

![]()

![]()

Infrastructure and Industrialization: Massive investments in roads, ports, power plants, and railways are closing long-standing gaps. Industrial parks in Ethiopia, Ghana and Rwanda illustrate a shift toward manufacturing and value addition.

The Green Economy: Renewable energy, electric mobility, and climate-smart investments are expected to generate millions of jobs by 2030. South Africa and Kenya are emerging as leaders in clean energy transitions.

Agricultural Transformation: Countries like Ethiopia and Côte d’Ivoire are moving from subsistence farming toward agro-processing, capturing more value from food systems and improving rural livelihoods.

Regional Trade under AfCFTA: The African Continental Free Trade Area (AfCFTA) is slowly reducing tariffs and non-tariff barriers, encouraging regional value chains and intra-African trade, which is critical for sustaining industrial growth.

Energy and Resources: Energy exporters such as Algeria and Angola continue to rely on hydrocarbons, even as pressure mounts to diversify into renewables and downstream industries. However, these projection-indicator growth is necklaced with some caveats.

The outlook to 2030 is optimistic but cautious. Debt distress, inflation, infrastructure deficits, political instability, etc. remain as the today’s factual risks. Also, economic size does not automatically translate into social progress. The defining question for Africa’s biggest economies will be governance roleplay to determine how effectively growth is managed, distributed and sustained.

By 2030, Africa’s largest economies are likely to look less like commodity outposts and more like complex, interconnected systems that would be driven by technology, regional trade, human capital, and the market volume.

The rankings may shift, but the realistic story is clear that Africa’s economic future is hinging more on the evolution of startups, technology, farming dynamics, factories, innovations, agrotech, sociocultural capital, cross-border markets across the continent and transnational partnerships.