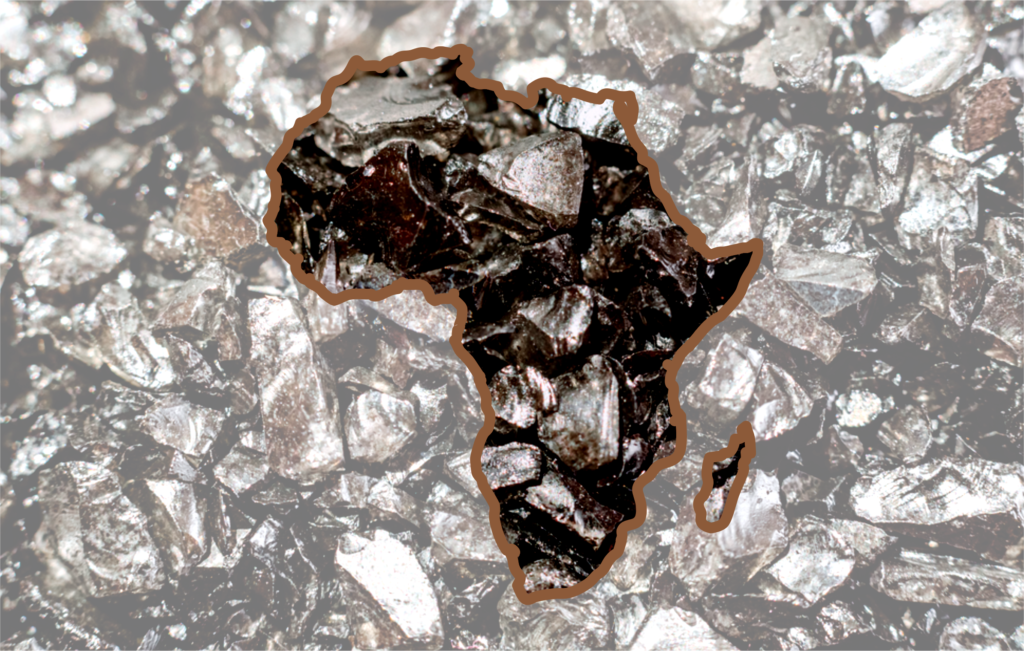

Africa’s Rare Earth Momentum Builds as Global Demand Set to Triple by 2035

As global demand for rare earth minerals accelerates, as projected to rise from 91,000 tons in 2024 to 150,000 tons by 2035, Africa is positioning itself at the heart of a strategic minerals race that could reshape both its economies and its geopolitical standing.

Forecast to account for at least 9% of global output by 2029, the continent’s rare earth sector is moving from geological promise to early-stage production. Behind the statistics lies an expansive story of industrial ambition, job creation and governments seeking greater leverage in a supply chain long dominated by a handful of producers. From potential resource to community impact.

Across southern and eastern Africa, exploration rigs are drilling not only for minerals, but for economic transformation. In Angola, UK-listed Pensana is preparing a 7,000-meter infill drilling campaign at the Longonjo project, expected to begin production in 2027. At full scale, the mine could supply up to 5% of global magnetic rare earths materials, essential for electric vehicles and wind turbines, while creating employment opportunities in mining, logistics and downstream processing. To most of the host communities, the stakes are tangible. Apart from royalties and export revenues, local leaders are pressing for training programmes, infrastructure upgrades and small-business participation in supply chains. In countries such as Botswana and Namibia, where new drilling campaigns are planned, governments are negotiating exploration licenses with stronger local content provisions, aiming to avoid the extractive ‘enclave’ model that has historically limited broader development gains.

In regards to the political leverage in a shifting supply chain, rare earths have become strategic assets amid intensifying global competition for critical minerals. As major economies seek to diversify supply away from traditional producers, African governments are leveraging this interest to secure financing, technology transfer and long-term trade partnerships.

In South Africa, the Steenkampskraal Monazite Mine secured funding from the Industrial Development Corporation in late 2025 to advance its metallurgical phase, an important step toward local beneficiation. Policymakers argue that refining and processing capacity, rather than raw exports, will determine whether Africa captures lasting value from the rare earth boom.

Malawi’s Songwe Hill project, backed by financing from the US International Development Finance Corporation, highlights the diplomatic dimension of the sector. Such investments signal growing Western engagement in Africa’s mineral landscape, adding a new layer to the continent’s global partnerships.

Analysts estimate Africa could attract up to $50 billion in critical minerals investment between 2024 and 2040. How these funds are structured, and whether they prioritize skills transfer, environmental protections and shared infrastructure, will shape public perception of the industry.

While investor appetite is rising, the subject of grassroots expectations and environmental scrutiny are enjoying the clamour of communities and civil society groups that demanding transparency. Rare earth extraction can generate radioactive by-products and requires careful waste management. Environmental advocates across Mozambique, Namibia and South Africa are calling for robust regulatory oversight, public consultation and clear rehabilitation plans.

In Mozambique’s Tete province, where Altona Rare Earths is drilling at the Monte Muambe project, community leaders have urged early disclosure of environmental impact assessments. Similar conversations are unfolding elsewhere as governments seek to balance rapid development with social license to operate.

The policy and investment momentum will converge at the upcoming African Mining Week 2026, scheduled for October 14-16, 2026, in Cape Town. Held alongside African Energy Week 2026, the gathering is expected to draw regulators, investors and project developers to discuss financing models, beneficiation strategies and regulatory alignment. As for most African policymakers, this forum offers a stage to articulate a unified continental approach to rare earth development, represents networking, integrates industrial policy, environmental governance and regional value chains.

As demand for electric mobility, renewable energy and advanced manufacturing intensifies, Africa’s rare earth momentum is becoming an inevitable asset-drive. The coming decade will test whether the continent can convert geological wealth into durable industrial capacity enabling local communities to enjoy the promised social dividends of a rapidly expanding global market.