China Leads Chad’s Oil Revival with US$4.5 Billion Refinery Upgrade as Western Firms Exit

Chad is embarking on a new chapter in its oil story, one written increasingly in Mandarin connection. As Western oil majors retreat, the Central African nation is deepening ties with China to resuscitate its struggling petroleum sector through a US$4.5 billion refinery expansion and a second refining facility.

A country that relies on oil for up to 60% of its export earnings, the move is both a survival strategy and a geopolitical pivot. Chad’s production, now hovering around 150,000 barrels per day, has been declining for years amid aging wells and disputes with foreign operators. The withdrawal of ExxonMobil, Chevron and Malaysia’s Petronas, over disagreements on taxes and ownership, left a vacuum that Beijing was quick to fill.

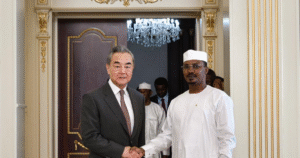

At the heart of the new deal is China National Petroleum Corporation (CNPC), which will upgrade the Djarmaya refinery near N’Djamena and spearhead construction of a second plant in the country’s east. Chad’s Secretary of State for Petroleum, Mines and Geology, Khadidja Hassane Abdoulaye, said CNPC had “positioned itself as the key partner” for expanding refining capacity and exploration in the southern basin.

Finance Minister Tahir Hamid Nguilin called the projects “timely and essential”. Stressing that local refining would not only cut costly imports but also create jobs and stabilize domestic fuel prices. A politically sensitive issue in a country where social tensions often rise with fuel shortages.

Chad’s embrace of Chinese investment reflects a broader African shift toward non-Western partners. From Niger to Mali, governments are diversifying alliances amid rising skepticism of Western influence and conditional aid. In benefit of N’Djamena, Beijing’s mix of infrastructure finance, diplomatic support and political non-interference offers an appealing alternative.

The refinery upgrade could also strengthen the position of President Mahamat Idriss Déby, who inherited power in 2021 following his father’s death. A visible economic revival anchored in energy infrastructure may help consolidate his legitimacy ahead of future elections. Though critics warn that cemented dependence on a single foreign partner carries long-term risks.

With the ordinary Chadians perspective, the project promises tangible benefits, such as potential job creation, expanded small business opportunities in logistics and services; and improved fuel access for transporters, farming machineries, etc. Families that have long struggled with power cuts and high fuel costs could see modest relief once local refining increases supply.

However, civil society groups are urging transparency. Past oil booms in Chad enriched elites but failed to translate into broad development. The challenge this time, they argue, is ensuring that Chinese-backed projects benefit communities rather than deepening debt and inequality.

Chad’s oil revival, guided by China, signals a quiet reshaping of Central Africa’s energy landscape. As Western firms pull back and Beijing deepens its foothold, the region’s future may depend less on global markets and more on strategic partnerships forged in the Global South.

Whether this leads to empowerment or new forms of dependency will depend on how Chad balances its immediate needs with long-term national control over its most vital resource.