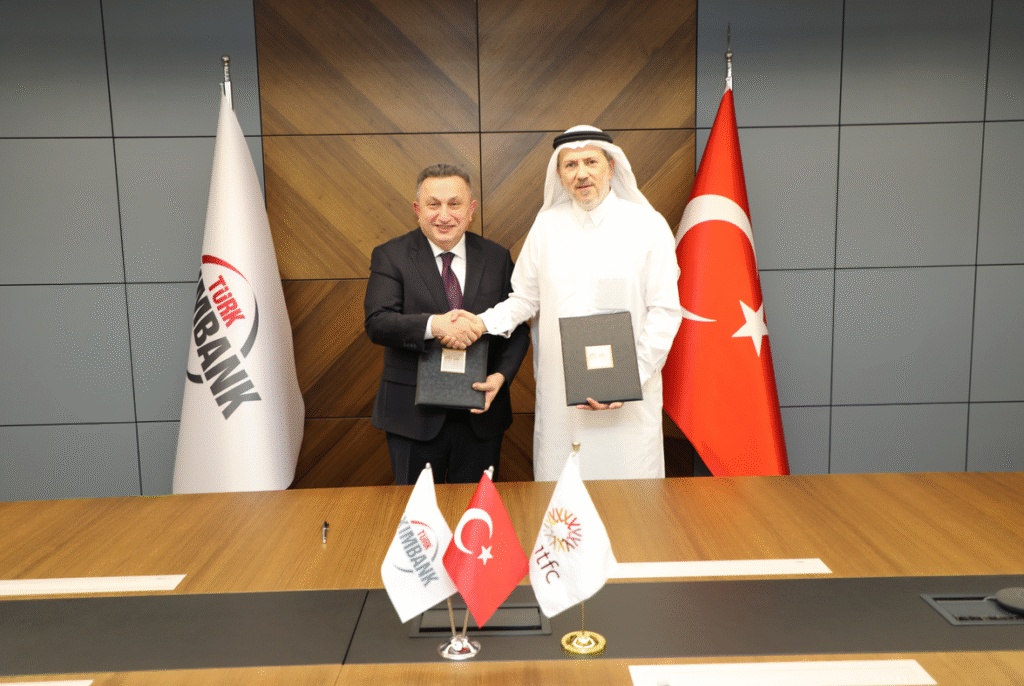

ITFC and Türk Eximbank Seal US$200 Million Deal to Power Türkiye’s SME Exports and Inclusive Growth

ISTANBUL, Türkiye – The International Islamic Trade Finance Corporation (ITFC), a member of the Islamic Development Bank (IsDB) Group, has signed a US$200 million syndicated Murabaha financing agreement with Türk Eximbank, marking a renewed commitment to supporting Türkiye’s export-driven private sector.

The deal is another milestone in a partnership that began in 2009, aimed to strengthen small and medium-sized enterprises (SMEs), expand access to Shariah-compliant trade financing, and enhance the global competitiveness of Turkish exports. Since their collaboration began, ITFC has approved roughly US$3.7 billion in financing for Türk Eximbank, a lifeline that has helped sustain thousands of businesses and jobs across the country.

Further than the financial headlines, the agreement carries broader implications for Turkish society. For families and communities, easier access to trade finance means greater job stability in export-dependent sectors such as textiles, agriculture, and manufacturing. The ripple effects could support household incomes at a time when inflation and global supply chain disruptions have strained ordinary citizens.

Culturally, the Murabaha model is a form of Islamic finance based on ethical, asset-backed transactions that reinforces Türkiye’s growing embrace of Islamic financial instruments, aligning with both faith-based principles and modern economic needs. This positions Türkiye as a bridge between traditional Islamic markets and global financial systems.

From a business perspective, the partnership features a national strategy to empower SMEs, which is the backbone of the Turkish economy. Linking them to international markets and capital flows. In respect to many small exporters, such facilities can mean the difference between stagnation and scaling up.

Politically, the deal aligns with Ankara’s focus on sustainable, inclusive economic policies and its vision of greater South-South cooperation through the Islamic Development Bank network. It also signals Türkiye’s intent to diversify its financing sources amid shifting global capital dynamics.

The agreement reflects an understanding that trade finance is not only about balance sheets but about livelihoods. Keeping factories running, preserving jobs and ensuring families can plan for their futures, creating a social effect to these elements of life.

As Türkiye continues to navigate a complex economic environment, partnerships like this one between ITFC and Türk Eximbank offer a model of proactiveness, where ethical finance meets national development; and where the health of the economy is measured in exports and human impact.