Nigeria’s trade rebounds as currency stabilises

Naira stability is driving trade rebound in Africa’s most populous nation.

For importers like Williams Dabo Group, it’s a long-sought relief.

“The stability has helped us to make forecasts for the import of products and raw materials for our industry,” Esther Williams, director and procurement officer at Williams Dabo Group, told BusinessDay.

A predictable naira has meant lower trade costs for the business, “especially Free on Board (FOB),” she said.

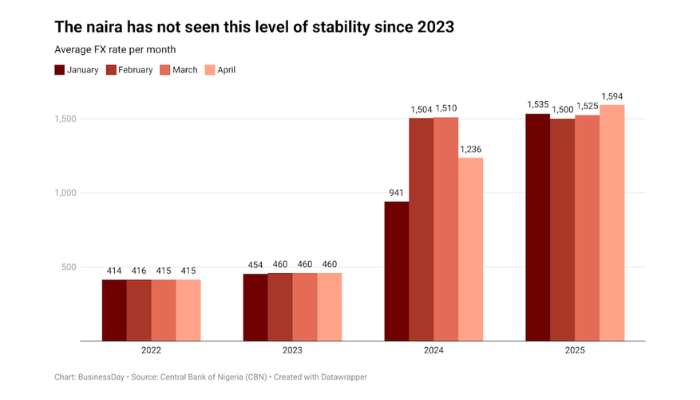

Since January this year, the naira has traded within a narrow band, averaging N1,544.25 per dollar, with its strongest pull at N1,477.72 in late January. This is a positive not just for Williams Dabo Group but also other businesses.

“It shows something good has been happening in the macro policies of the central bank over the last two years. We’re now at a new normal,” said George Coleman, CEO of Coleman Wires and Cables.

Coleman, whose company supplies cables to infrastructure and industrial projects within West Africa, said the naira’s stability, not witnessed since the first quarter of 2023, has brought benefits, including some level of stability in decision making “and also invariably increased investments.”

Businesses across sectors have reported sharp declines in FX-related losses, with a BusinessDay survey showing a drop from N951.7 billion in the first quarter (Q1) of 2024 to just N28.7 billion in Q1 2025.

At the same time, the Nigeria Customs Service processed more import declarations in the Q1 of this year, calculated at 327,928, compared to 311,492 within the same period in 2024.

Coleman, who is also the chairman of the Manufacturers Association of Nigeria Ogun State chapter, told BusinessDay that he is particularly excited about the rising momentum in the sector.

Banks’ confidence returns

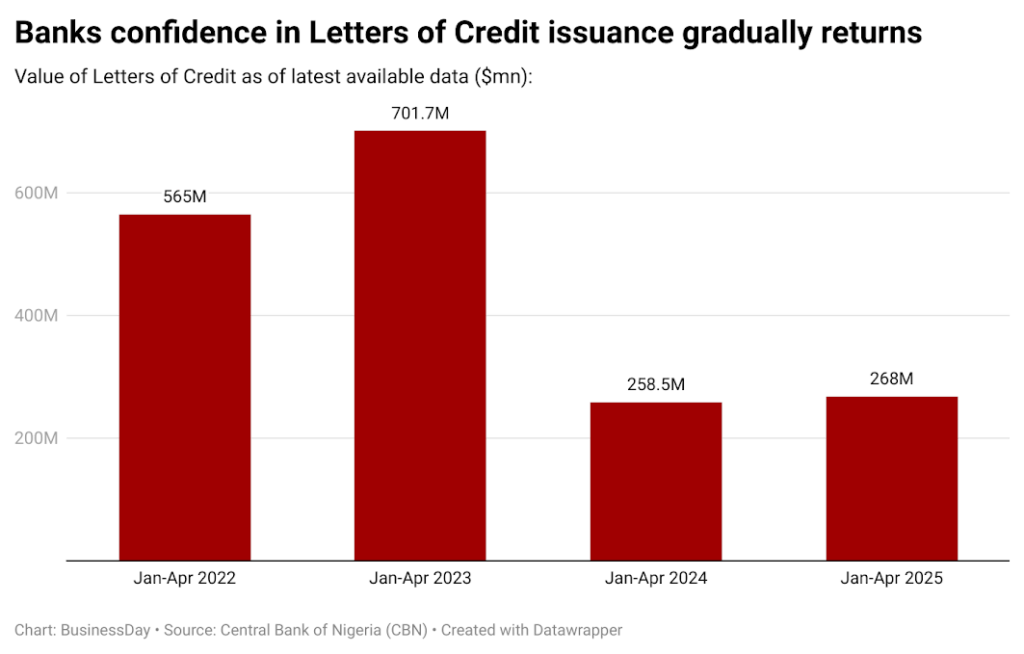

A BusinessDay survey of letters of credit issued by banks, which are often assurances by Nigerian importers to foreign manufacturers that payment for import goods will be made—showed recovery in the first four months of the year after a dip in 2024.

Tajudeen Ibrahim, an economist and director of research at Chapel Hill Denham Securities, said there’s an increase in confidence level in the naira.

He said there is a significant improvement in liquidity, which makes this possible.

Ibrahim said the fact that Nigeria’s commercial banks now allow customers to use their naira cards for foreign purchases “is an early indication that things are improving.”

Williams Dabo Group told BusinessDay that bank confidence in issuing letters of credit is “an added advantage as the risk of exchange rates fluctuations has improved.”

The stability, Ibrahim told this reporter, is largely driven by foreign portfolio investments attracted by high interest rates.

Predicable pricing

Like Williams Dabo, the biggest gain so far for many in manufacturing has been the predictability of pricing.

Similarly, at Amayi Foods, where some components of its packaging are imported by the suppliers, price swings were once common.

“Last year, packaging pricing was increasing very quickly. The price will change every two weeks or less,” said Kudzayi Hove, the company’s co-founder. “But pricing has been a little stable now. We’ve been paying the same rate for a while.”

Hove told BusinessDay that her company has enjoyed some calm, rare in Nigeria’s trade environment, unlike during devaluation periods when they were forced to adjust pricing and sourcing to ‘hedge’ against the impact.

“We’re on a bit of an even peel…not expecting costs to rise or seeing costs rising sharply.”

That kind of predictability has long been missing from Nigeria’s import system, said Jonathan Nicol, former chairman of the Shippers’ Association of Lagos State.

“There is nothing as good as you wake up in the morning, you make your projections, and the system supports it,” he said. “You can now place orders for whatever you want to import, and it remains unchanged. Then you are in business.”

Still, Nicol noted that while FX stability has been a welcome change, the gains are sometimes neutralised by high port charges and operational inefficiencies.

“The exchange rate may be good, but at the end of the day, you go to the shipping lines and terminal operators, you lose the small money that you have made through foreign exchange,” he said.

Customs reported that in Q1 of the year, the currency’s value changed over 60 times, affecting the pricing of duties paid by importers.

Nicol urged the government to reduce the broader cost of doing business and to resolve lingering issues with Customs processes that complicate cargo clearing and raise final delivery costs. For now, the gains are cautious.